Short Tax Form purchases a fourplex on January 8, 2019, for ($175,000.) She allocates ($25,000) of the

Question:

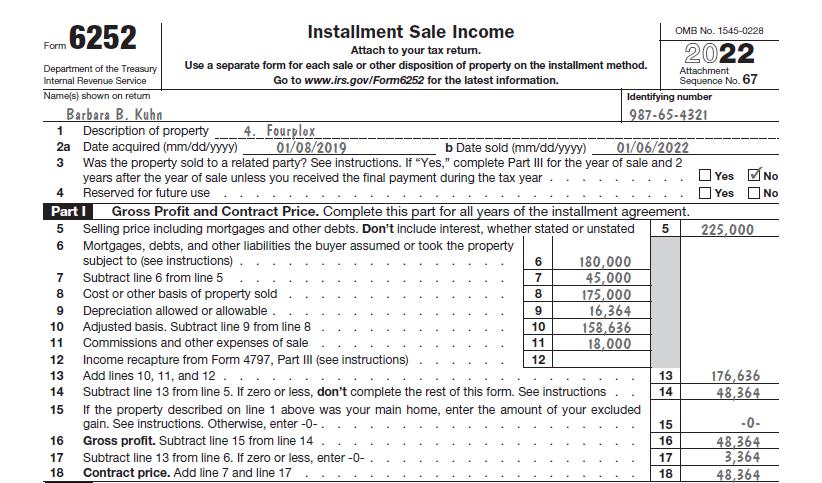

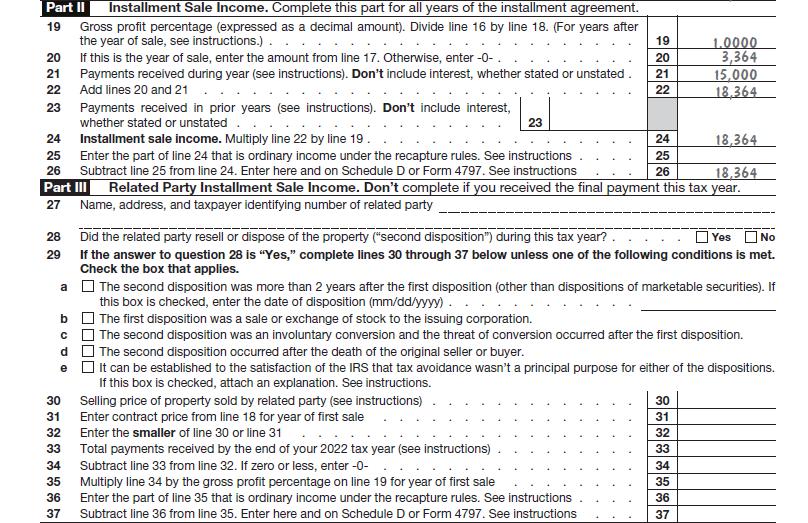

Short Tax Form purchases a fourplex on January 8, 2019, for \($175,000.\) She allocates \($25,000\) of the cost to the land, and she deducts MACRS depreciation totaling \($16,364.\) Barbara sells the fourplex to an unrelated person on January 6, 2022, for \($225,000.\) The buyer assumes the existing mortgage of \($180,000,\) pays \($15,000\) down, and agrees to pay \($15,000\) per year for two years plus 12% interest. Barbara incurs selling expenses of \($18,000.\) Complete Form 6252.

Data From Form 6252

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: