Stan uses a car 100% for his sole proprietorship. In January 2023, Stan must decide whether to

Question:

Stan uses a car 100% for his sole proprietorship. In January 2023, Stan must decide whether to buy or lease a new car. After bargaining with several car dealers, Stan has agreed to a price of \($75,000.\) If he buys the car, he will borrow the entire \($75,000\) at a 6% annual interest rate, and his payments will be \($1,449.96\) per month over 60 months.

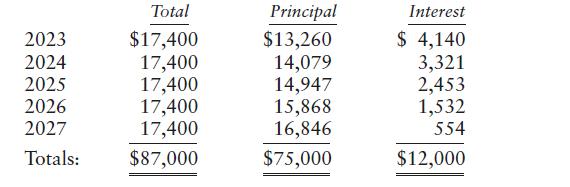

Annual principal and interest payments are:

If Stan purchases the car, he will not claim Sec. 179 expensing or bonus depreciation, the half-year convention will apply, and he will sell the car for \($23,000\) at the end of five years. If Stan leases it, his monthly lease payment will be \($1,120\) for 60 months, and he will turn in the car at the end of the five-year lease period. (He does not plan to exercise the lease’s option to purchase the car for \($23,000\) at that time.)

Using present value analysis, is Stan better off buying the car or leasing it? Assume the following in your analysis:

Stan’s marginal tax rate is 24% each year.

• The lease inclusion amount for each year is \($272\) (which is the average of the five lease inclusion amounts for a \($75,000\) vehicle).

• For the alternative of buying the car, Stan discounts cash flows (including tax savings)

at a 6.2% annual rate. For the alternative of leasing it, Stan discounts cash flows (including tax savings) at a 0.5% monthly rate (one-twelfth of 6%; this 0.5% rate, compounded monthly, is approximately equal to a 6.2% annual rate).

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson