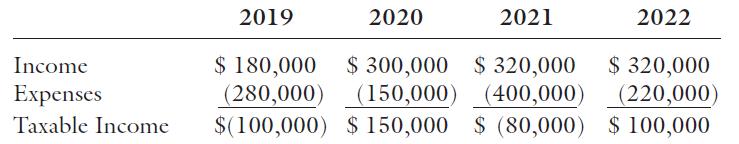

Habiby, Inc., began operations in 2019 and has the following income and expenses for 2019 through 2022.

Question:

Habiby, Inc., began operations in 2019 and has the following income and expenses for 2019 through 2022.

a. What is the amount of tax that Habiby should pay each year?

b. How much would Hadley paid in tax if the old NOL rules were in place but the corporate tax rate was 21 percent?

Transcribed Image Text:

2019 2020 2021 2022 $ 180,000 $ 300,000 $ 320,000 (150,000) (400,000) $(100,000) $ 150,000 $ (80,000) $ 100,000 $ 320,000 (220,000) Income Expenses (280,000) Taxable Income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

a 2019 Habiby would pay no tax in 2019 due to its NOL for that year The NOL can be carried forward indefinitely 2020 Habiby would pay tax of 10500 21 ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted:

Students also viewed these Business questions

-

The corporate income tax rates in two countries, A and B, are 40 percent and 25 percent, respectively. Additionally, both countries impose a 30 percent withholding tax on dividends paid to foreign...

-

Habiby, Inc., has the following income and expenses for 2014 through 2017. What is the amount of tax that Habiby should pay each year? Use the corporate tax rate schedules in Appendix B to compute...

-

Habiby, Inc., has the following income and expenses for 2009 through 2012. What is the amount of tax that Habiby should pay each year? Use the corporate tax rate schedules in Appendix A to compute...

-

Write a bash shell script which calculate BMI (Body Mass Intensive). The BMI formula uses your weight (in kg or pounds) and your height (in meters or inches) to form a simple calculation that...

-

For comparison purposes, mutual funds are often grouped into various categories. Do Canadian equity funds and Canadian balanced equity funds differ with respect to percentage of foreign holdings...

-

Ann, Jim, John, and Nancy are scheduled to compete in a racquetball tournament. Ann is twice as likely to beat Jim, and Jim is at the same level as John. Nancys past winning record against John is...

-

Using the figure in the Application "A Semiconductor Integrated Circuit Isoquant," show that as the firm employs additional fixed-proportion technologies, the firm's overall isoquant approaches a...

-

Your supervising attorney asks you to locate the digest topic and key numbers for the Glover v.Lockheed Corp. case listing. He remembers it is a Federal Supplement case, but he cannot remember the...

-

. 1. Consider an OLG economy in which the number of initial old (at t = 0) is equal to 10,000. Let the population change according to Nt = 1.1Nt1 Agents' preferences are such that: u(c1, c2) = c 35 1...

-

Jimmy owns a garden in which he has planted N trees in a row. After a few years, the trees have grown up and now they have different heights. Jimmy pays much attention to the aesthetics of his...

-

The Graves Corporation was incorporated in 2019 and incurred a net operating loss of $35,000. The companys operating income in 2020 was $47,000. Because of a downturn in the local economy, the...

-

Mort is the sole owner of rental real estate that produces a net loss of $18,000 in 2019 and $20,000 in 2020 and income of $6,000 in 2021. His adjusted gross income, before considering the rental...

-

How do financial accounting and management accounting differ?

-

How will you react to the resorts reputation of rough starts, but it gets better after you've been working there for a while?

-

What do you do when someone doesn't answer her well or spends less time talking to you?

-

Sometimes a construction has a long-term project like building a skyscraper in Chicago for another company for which it is paid quarterly for the work it has done each quarter over a five-year...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 82,000 Daks each year at a selling price of $62 per unit. The company's unit costs at this level of...

-

An audit firm's audit documentation DOES NOT ______. Multiple choice question. assist supervisors in reviewing work quality assist in planning future audits demonstrate audit team accountability...

-

In 2013, Julie, a single individual, reported the following items of income and deduction: Salary ....................................................................... $166,000 Interest income...

-

Which of the following gives the range of y = 4 - 2 -x ? (A) (- , ) (B) (- , 4) (C) [- 4, ) (D) (- , 4] (E) All reals

-

What alternatives does a producer have if it is trying to expand distribution in a foreign market and finds that the best existing merchant wholesalers wont handle imported products?

-

Discuss the future growth and nature of wholesaling if chains, scrambled merchandising, and the Internet continue to become more important. How will wholesalers have to adjust their mixes? Will...

-

Art Glass Productions, a producer of decorative glass gift items, wants to expand into a new territory. Ma n agers at Art Glass know that unit sales in the new territory will be affected by consumer...

-

a firm ABC issues a bond with a par value of $1,000. The bond matures in 8 years and pays semiannual coupons. the coupon rate is 8.36% and the YTM of the bond is 9.25%. what is the price of the bond?

-

Given the following functions: A f(x)=1 E f(x) = sinx B f(x)=x F f(x) = cos x f(x) = x C G f(x) = log x 1 D f(x)=- H f(x)=2* Place an 'X' in the box next to the appropriate function(s) with the...

-

Consider the various types of functions that can be used for mathematical models, which types of function(s) could be used to describe a situation in which the number of individuals in an endangered...

Study smarter with the SolutionInn App