Imagine this is January 1, 2002. You are head of the loan department at the High Growth

Question:

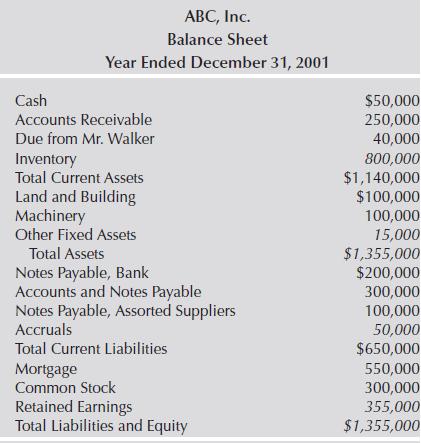

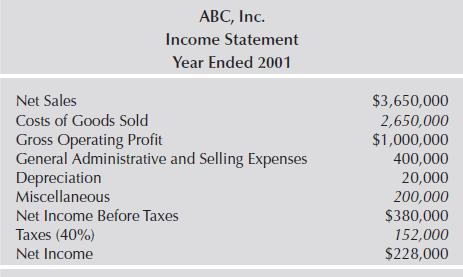

Imagine this is January 1, 2002. You are head of the loan department at the High Growth Bank of Los Angeles. Mr. Alex Walker, the founder and CEO of ABC, Inc., a small manufacturing firm, comes to you with a request for a loan that his company will need no later than March 1, 2002. He has indicated that the company will repay the loan February 28, 2003, with principal and interest. ABC’s balance sheet and income statement are given below.

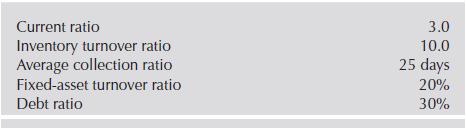

In addition to the above information, you have the following ratios, which are averages of the industry to which ABC belongs.

An important consideration in this loan request is whether or not ABC can internally generate the funds needed to repay the loan by conforming more closely to industry averages. The loan request is for $650,000. You have not determined the loan interest rate yet, but the current annual borrowing rate for this customer is 10%. Your expectation is that ABC’s borrowing rate over the next few months will stay at about 10%. Should you make this loan? If you decide to make the loan, present a qualitative analysis of this loan request and make a summary statement of the necessary loan covenants. There should be at least one affirmative covenant, one negative covenant, and one restrictive clause. You are required to present a brief summary of additional information that could have improved your analysis. (Be specific.)

Step by Step Answer:

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot