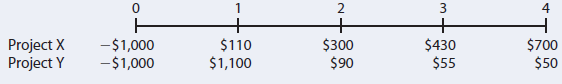

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: The

Question:

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: The projects are equally risky, and their WACC is 11%. What is the MIRR of the project that maximizes shareholder value?

The projects are equally risky, and their WACC is 11%. What is the MIRR of the project that maximizes shareholder value?

Transcribed Image Text:

3 Project X Project Y -$1,000 -$1,000 + $300 $90 + $430 $55 $700 $50 $110 $1,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 44% (9 reviews)

Because both projects are the same size you can just cal...View the full answer

Answered By

Robert Mbae

I have been a professional custom essay writer for the last three years. Over that period of time, I have come to learn the value of focusing on the needs of the clients above everything else. With this knowledge, I have worked hard to become an acclaimed writer that can be trusted by the customers to handle the most important custom essays. I have the necessary educational background to handle projects up to the Ph.D. level. Among the types of projects that I've done, I can handle everything within Dissertations, Project Proposals, Research Papers, Term Papers, Essays, Annotated Bibliographies, and Literature Reviews, among others.

Concerning academic integrity, I assure you that you will receive my full and undivided attention through to the completion of every essay writing task. Additionally, I am able and willing to produce 100% custom writings with a guarantee of 0% plagiarism. With my substantial experience, I am conversant with all citation styles ranging from APA, MLA, Harvard, Chicago-Turabian, and their corresponding formatting. With all this in mind, I take it as my obligation to read and understand your instructions, which reflect on the quality of work that I deliver. In my paper writing services, I give value to every single essay order. Besides, whenever I agree to do your order, it means that I have read and reread your instructions and ensured that I have understood and interpreted them accordingly.

Communication is an essential part of a healthy working relationship. Therefore, I ensure that I provide the client with drafts way long before the deadline so that the customer can review the paper and comment. Upon completion of the paper writing service, the client has the time and right to review it and request any adjustments before releasing the payment.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Business questions

-

A manufacturing firm is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value . The initial cost and the net year-end revenue for...

-

A firm is considering two mutually exclusive projects, as follows. Determine which project should be accepted if the discount rate is 15 percent. Use the chain replication approach. Assume both...

-

A manufacturing firm is considering two mutually exclusive projects. Both projects have an economic service life of one year with no salvage value . The first cost of Project 1 is $1,000, and the...

-

A utilization greater than one suggests that the mean service time is higher than the mean inter-arrival time. True False QUESTION 3 It costs five times more money to retain a current customer than...

-

a) Distinguish between file/directory data backup and image backup. b) Why is file/directory backup attractive compared with image backup? c) Why is image backup attractive compared with...

-

What is the difference between oil shale and shale oil?

-

This case stems from a rocky relationship between two Texans. Lawrence Shipley was the president of Shipley Do-Nut Flour & Supply Co., and Andrea Vasquez was a substitute school teacher in the...

-

Bathworks produces hair and bath products. Bathworks owner would like to have an estimate of the companys net income in the coming year. Required Project Bathworkss net income next year by completing...

-

1. A hollow conducting sphere has an inner and outer radius of R and R2 respectively. A point charge of +Q sits inside the hollow sphere at the center. Additionally, a charge of +2Q is distributed...

-

Taneshas company is looking at options for migrating some of their web servers to a cloud service. However, no one on the team currently knows much about cloud providers and what kinds of services...

-

What purpose do rules of operator associativity serve in a programming language?

-

Describe the purpose and characteristics of NaN.

-

Carolina Company experienced the following events during 2013. 1. Acquired $50,000 cash from the issue of common stock. 2. Paid $15,000 cash to purchase land. 3. Borrowed $25,000 cash. 4. Provided...

-

Consider the following monopoly with P = 30.5 -2.75 Q and the marginal cost curve is MC=4.5Q; a.Calculate the consumer surplus under the monopoly. b. Calculate the producer surplus under the...

-

A rod (Body 3) slides through a collar (Body 2) which is held by a rotating fork (Body 1). Body 3 can be treated as a slender rod, while bodies 1 and 2 are massless. A force F acts at end B and...

-

Represent the gcd (252, 198) as a linear combination of 252 and 198. Show all work. (For example, if X is the gcd, then solution is X = 252a + 198 b) Compute 325 mod 35 using the algorithm for (fast)...

-

a) Suppose you need to represent the following information in a database. Now draw an ER Diagram with proper symbols identifying different types of attributes used: MOVIE Movie_name Year Genre...

-

a first faces the demand curve, Q=180-5p, and has the cost equation, c=100+24Q. what is the equation for the firm's marginal revenue?

-

Identify whether each of the following is most likely (a) A debt or equity investment, and (b) A non-strategic or strategic investment. (c) Identify the most likely reason (such as earning gains,...

-

Air pollution generated by a steel mill is an example of a) a positive production externality. b) a negative production externality. c) a public good. d) the free-rider problem. State and local taxes...

-

Assume that Allied's average project has a coefficient of variation (CV) in the range of 1.25 to 1.75. Would the lemon juice project be classified as high risk, average risk, or low risk? What type...

-

Most firms generate cash inflows every day, not just once at the end of the year. In capital budgeting, should we recognize this fact by estimating daily project cash flows and then using them in the...

-

What are some differences in the analysis for a replacement project versus that for a new expansion project? Discuss.

-

The controller for Tulsa Medical Supply Company has established the following activity cost pools and cost drivers. Machine setups Budgeted Overhead Cost Cost Driver Number of setups Weight of raw...

-

In 2023, Miranda records net earnings from self-employment of $168,500. She has no other income. Determine the amount of Miranda's self-employment tax and her AGI income tax deduction. In your...

-

Describe how empowerment, work groups, and multifunctional teams would or would not affect the five types of problems.

Study smarter with the SolutionInn App