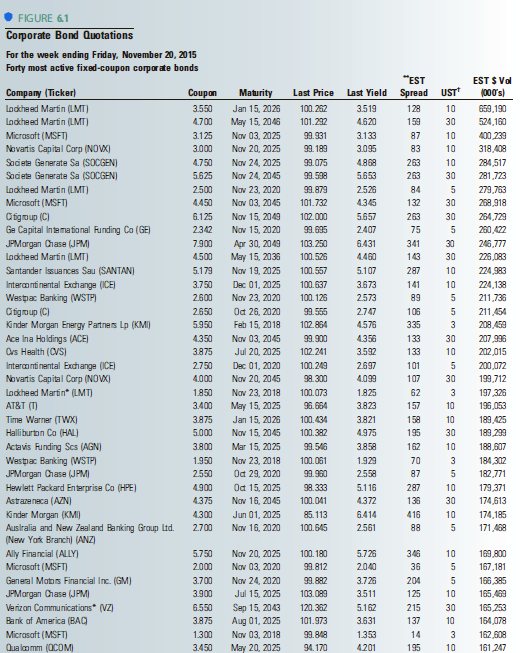

Refer to the bonds appearing in Figure 6.1. a. What is the coupon rate and year of

Question:

a. What is the coupon rate and year of maturity for the Qualcomm and Time Warner bonds?

b. How much would you have had to pay to buy one Bank of America bond at the closing trade?

c. Why is the yield-to-maturity on the Hewlett Packard Enterprise bonds of 2025 higher than the yield on the AT&T bonds of 2025?

A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's face or par value. The coupon rate, or coupon payment, is the yield...

FIGURE 61 Coporate Bond Quotations For the week ending Friday. November 20, 2015 Forty most active fixed-coupon corporate bonds "EST Last Yield Spread EST $ Vol UST (000's) Company (Ticker) Coupon Maturity Last Price G59,190 lockheed Martin (LMT) 3.550 Jan 15, 2026 100.262 3.519 128 10 Lockheed Martin (LMT) Micrasaft (MSFT) May 15, 2046 4.700 101.232 4.620 159 30 524,160 9. 331 3.125 Nov 03, 2025 3.133 87 10 400,239 3.095 Novartis Capital Corp (NOVX) Socete Generate Sa (SOCGEN) Socete Generate Sa (SOCGEN) 3.000 Νoν 20, 2025 99. 189 83 10 318,408 4.750 Nov 24, 2025 284,517 99.075 4.868 263 10 99. 538 99.879 281,723 5.625 Nov 24, 2045 5.653 263 30 lokheed Martin (LMT) 2500 Nov 23, 2020 2526 84 279,763 Micrasaft (MSFT) Nov 03, 2045 4.450 101.732 4.345 132 30 268,918 Cigoup (C) Ge Capital Intematio nal Funding Co (GE) JPMargan Chase (JPM) lokheed Martin (LMT) Nov 15, 2049 6.125 2342 102.000 5.657 263 30 264,729 99.695 Nov 15, 2020 2407 75 260,422 7.900 Apr 30, 2049 May 15, 2036 103.250 6.431 341 30 246,777 4.500 100.526 4.460 143 30 226,083 Santander Issuances Sau (SANTAN) 5.107 5.179 Nov 19, 2025 100.557 287 10 224,383 Intercontinental Exchange (ICE) 3.750 2.600 Dec 01, 2025 100.637 3.673 141 10 224,138 Westpac Banking (WSTP) Nov 23, 2020 100. 126 2573 89 211,736 Cigoup (C) Kinder Margan Energy Partners Lp (KMI) Od 26, 2020 2650 99.555 2.747 106 211,454 5.950 Feb 15, 2018 102.864 4.576 335 3 208,459 4.350 Ace Ina Holdings (ACE) Nov 03, 2045 99.900 4.356 133 30 207,996 202,015 Ors Health (CVS) 3.875 Jul 20, 2025 102.241 3.592 133 10 Intercontinental Exdhange (ICE) Novartis Capital Carp (NOVX) Lockheed Martin* (LMT) 2.750 200,072 Dec 01, 2020 100.249 2.697 101 4.000 Nov 20, 2045 98.300 4.099 107 30 199,712 Nov 23, 2018 1.850 100.073 1.825 62 3 197,326 96. 664 AT&T () May 15, 2025 196,053 3.400 3.823 157 10 Time Warner (TWX) Halliburton Co (HAL) Actavis Funding Scs (AGN) 3.875 Jan 15, 2026 100.434 3.821 158 10 189,425 5.000 Nov 15, 2045 100.382 4.975 195 30 189 299 3.800 Mar 15, 2025 99.546 3.858 162 10 188,607 1950 Westpac Banking (WSTP) JPMargan Chase (JPM) Hawlett Packard Enterprise Co (HPE) Astrazeneca (AZN) Nov 23, 2018 Oct 29, 2020 Od 15, 2025 Nov 16, 2045 100.061 1.929 70 3 184,302 2550 99.960 2.558 87 182,771 4.900 98.333 5.116 287 10 179,371 4.372 4.375 100.041 136 30 174,613 Kinder Margan (KMI) Auslralia and New Zaaland Banking Group Ltd. (New Yak Branch) (ANZ) Jun 01, 2025 4.300 85.113 6.414 416 10 174,185 Nov 16, 2020 2.700 100.645 2.561 88 171,468 Ally Financial (ALLY) Micrasaft (MSFT) General Motos Financial Inc. (GM) 5.750 Nov 20, 2025 100. 180 5.726 346 10 169,800 Nov 03, 2020 2.000 99.812 2.040 36 167,181 166,385 3.700 Nov 24, 2020 99.882 3.726 204 165,469 JPMargan Chase (JPM) 3.900 Jul 15, 2025 103.089 3.511 125 10 Sep 15, 2043 Aug 01, 2025 Nov 03, 2018 May 20, 2025 165,253 164,078 Verizan Communications* (VZ) 6.550 120.362 5.162 215 30 Bank of America (BAQ 3.875 101.973 3.631 137 10 Micrasaft (MSFT) Qualoomm (OCOM) 99.848 162,608 1.300 1.353 14 3 94. 170 4201 161 247 3.450 195 10

Step by Step Answer:

a Qualcom 345 2025 Time Warner 38...View the full answer

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Refer to the five bonds appearing in Figure. a. What is the coupon rate and year of maturity for each bond? b. How much would you have had to pay to buy one Bank One bond at the closing trade? c. Why...

-

How much would you have to save each year to have $65,000 in 10 years if the interest rate is expected to be 7%?

-

Refer to Figure. What activities must be accomplished before Input Response Data can start? What activities can start after Review Comments & Finalize Questionnaire has finished? List two activities...

-

Consider the Cobb-Douglas production function with X=l 1 l 2 where +l 1 , where d>0. (a) Denoting the input prices by w 1 and w 2 , derive the cost function as it depends on x and e. Show that it...

-

A log carrier has a body made from a 4-ft length of reinforced cloth having a patch on each side and a dowel slid through each end to act as handles. The parts-listing matrix for the log carrier is...

-

The pitcher in a slow-pitch softball game releases the ball at a point 3.0 ft above ground level. A stroboscopic plot of the position of the ball is shown in Figure, where the readings are 0.25 s...

-

What are the main objectives of an international compensation plan? Would an integrated solution or a best-of-breed solution make more sense for a large manufacturing corporation? Do you believe that...

-

Winter Sports Manufactures snowboards. Its cost of making 23,600 bindings is as follows: Direct materials.................................................................................. $ 24,000...

-

On January 1, 2024 , Stone leased an office building . terms of the lease require stone to make 15 annual lease payments of $135,000 beginning on leased an office building. Terms of the lease...

-

The idea for Honest Tea came about in 1997, when Yale School of Management graduate Seth Goldman stopped for a post-workout beverage at a local convenience store. Finding only soft drinks and teas...

-

Consider again the BCC 8 percent debentures that mature on July 15, 2036 (see problem 6). Determine the yield to call if the bonds are called on July 15, 2022, at $1,016.55.

-

Zip Boys has outstanding zero coupon bonds maturing in 2018. a. How would you compute the yield-to-maturity on bonds like these? b. How do bondholders get a return when they buy these bonds?

-

Lockard Company purchased machinery on January 1, 2010, for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. (a) Compute 2010 depreciation expense...

-

Company A announced an offer to buy Company B for $22/sh; $17/sh in cash, $5/sh in stock (Explain) Cash component is about $22 Bn Revenue of target is 6.5x the acquiror Combined EBITDA is $6.5 Bn...

-

1). In October, what is the total costs transferred from Department A to Department B? In using FIFO method, Masipag Company produces a product that undergoes three processes and the completed items...

-

Max Laboratories Inc. has been operating for over thirty years producing medications and food for pets and farm animals. Due to new growth opportunities they are interested in your expert opinion on...

-

How did he get the second equation (i.e what is the integration method for function f(x,y,y')). please help me with the solution step by step. y(x) dxdx = * (x,y,y) dxdx y(x)-y(x)-hy'(x) = f(x -...

-

Below is the trial balance of Seri Andalas Sdn Bhd as at 30 September 2022 Seri Andalas Sdn Bhd Trial Balance as at 30 September 2022 Particulars Stock on 1 October 2021 Carriage Outwards Carriage...

-

You are purchasing a new TV at Visions Electronics and the salesperson is trying to convince you to buy a five-year extended warranty. The cost of the warranty to you today will be $399. However, if...

-

Convert the numeral to a HinduArabic numeral. A94 12

-

Explain the differences in the responsibilities of the treasurer and the controller in a large corporation.

-

Explain the relationship between financial management and (a) Microeconomics and (b) Macroeconomics.

-

Why is earnings per share not a consistently good measure of a firms performance?

-

4. A partnership owns an aging 4-unit retail center in a local campus property. Cash flow projections for the next 10 years are: $50,000 for years 1 and 2; $60,000 for years 3 and 4; $70,000 for...

-

given A = 2 -2 3 ' 3 4 2 , 4 2 5 2 2 B= 3 -3 2 2 1 2 1 4 2 2 3 F= 4 2 3 - 2 -2 4 2 3 2 3 4 2 4 I Find the resulting matricas based on the arth metic operation. attach solution on your the comment...

-

The 40 members of a recreation class were asked to name their favorite sports. The table shows the numbers who responded in various ways. Use information given in the table to answer the following...

Study smarter with the SolutionInn App