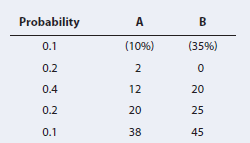

Stocks A and B have the following probability distributions of expected future returns: a. Calculate the expected

Question:

a. Calculate the expected rate of return, r'B, for Stock B (r'A= 12%).

a. Calculate the expected rate of return, r'B, for Stock B (r'A= 12%).b. Calculate the standard deviation of expected returns, σA, for Stock A (σB= 20.35%). Now calculate the coefficient of variation for Stock B. Is it possible that most investors will regard Stock B as being less risky than Stock A? Explain.

c. Assume the risk-free rate is 2.5%. What are the Sharpe ratios for Stocks A and B? Are these calculations consistent with the information obtained from the coefficient of variation calculations in part b? Explain. Stocks

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: