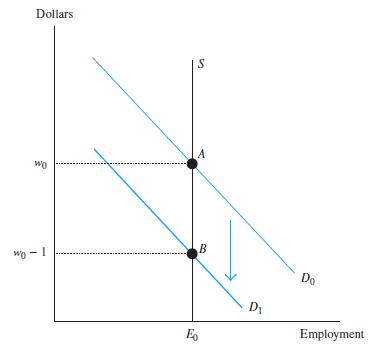

Figure 4-6 shows that a payroll tax will be completely shifted to workers when the labor supply

Question:

Figure 4-6 shows that a payroll tax will be completely shifted to workers when the labor supply curve is perfectly inelastic. In this case, for example, a new \($2\) payroll tax will lower the wage by \($2,\) will not affect employment, and will not result in any deadweight loss. Suppose instead that labor supply is perfectly elastic at a wage of \($10.\) In this case, what would be the effect on wages, employment, and deadweight loss from a \($2\) payroll tax?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: