A company was incorporated on 1st July, 2016 to take over the business of Mr M as

Question:

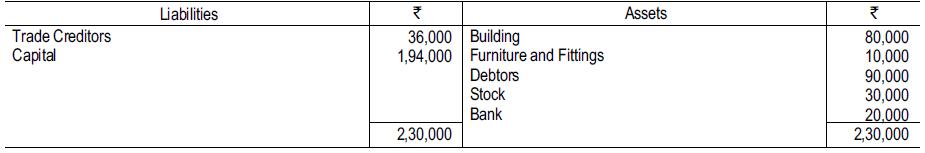

A company was incorporated on 1st July, 2016 to take over the business of Mr M as and from 1st April, 2016. Mr M’s Balance Sheet as at that date was as under:

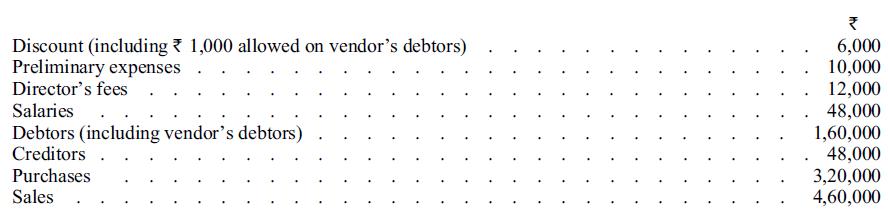

Debtors and Bank balances are to be retained by the vendor and creditors are to be paid off by him. Realisation of debtors will be made by the company on a commission of 5% on cash collected. The company is to issue M with 10,000 equity shares of ₹ 10 each, ₹ 8 per share paid and cash of ₹ 56,000. The company issued to the public for cash 20,000 equity shares of ₹ 10 each on which by 31st March, 2017, ₹ 8 per share was called and paid up except in the case of 1,000 shares on which the third call of ₹ 2 per share had not been realised. In the case of 2,000 shares, the entire face value of the shares had been realised. The share issue was underwritten for 2 % commission, payable in shares fully paid up. In addition to the balances arising out of the above, the following were shown by the books of account of the company on 31st March, 2017:

Stock on 31st March, 2017 was ₹52,000. Depreciation at 10% on Furniture and fittings and at 5% on Building is to be provided. Collections from debtors belonging to the vendor were ₹60,000 in the period. Prepare the Trading and Profit and Loss Account for the period ended 31st March, 2017 of the limited company and its Balance Sheet as at that date.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee