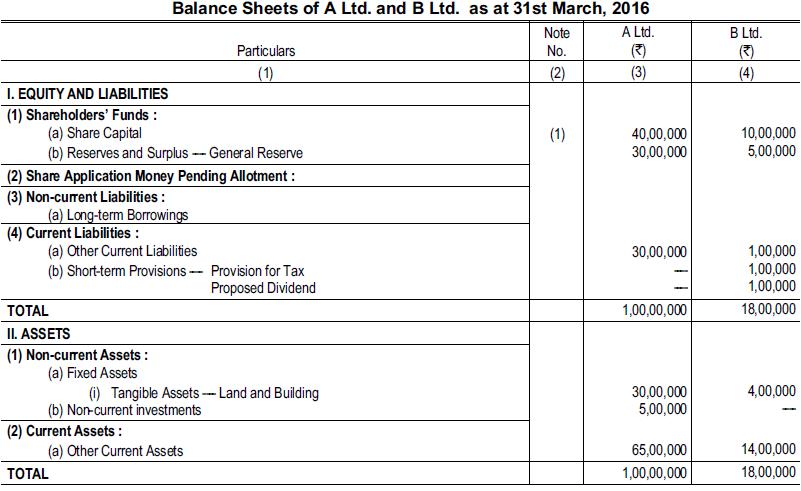

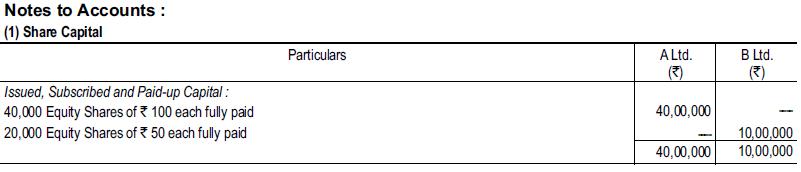

Following are the Balance Sheets of A Ltd. and B Ltd. as on 31.3.2016: B Ltd. is

Question:

Following are the Balance Sheets of A Ltd. and B Ltd. as on 31.3.2016:

B Ltd. is to be absorbed by A Ltd. on the following terms :

(1) B Ltd. declares a dividend of 10% before absorption for the payment of which it is to retain sufficient amount of cash.

(2) For the purpose of absorption each share of B Ltd. is worth ₹ 72.50.

(3) The purchase consideration is satisfied by the issue of fully paid-up shares of ₹ 100 each in A Ltd.

(4) All assets and liabilities are taken over at book value except fixed assets and stock. Fixed assets were valued at ₹ 3,50,000.

Following further information is also to be taken into consideration :

(a) A Ltd. holds 5,000 shares of B Ltd. at a cost of ₹ 3,00,000.

(b) The stocks of B Ltd. include items valued at ₹ 1,00,000 purchased from A Ltd. (cost to A Ltd. ₹ 75,000).

(c) The creditors of B Ltd. include ₹ 50,000 due to A Ltd. Show Ledger Accounts in the books of B Ltd. to give effect of the above and Balance Sheet of A Ltd. after completion of the absorption.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee