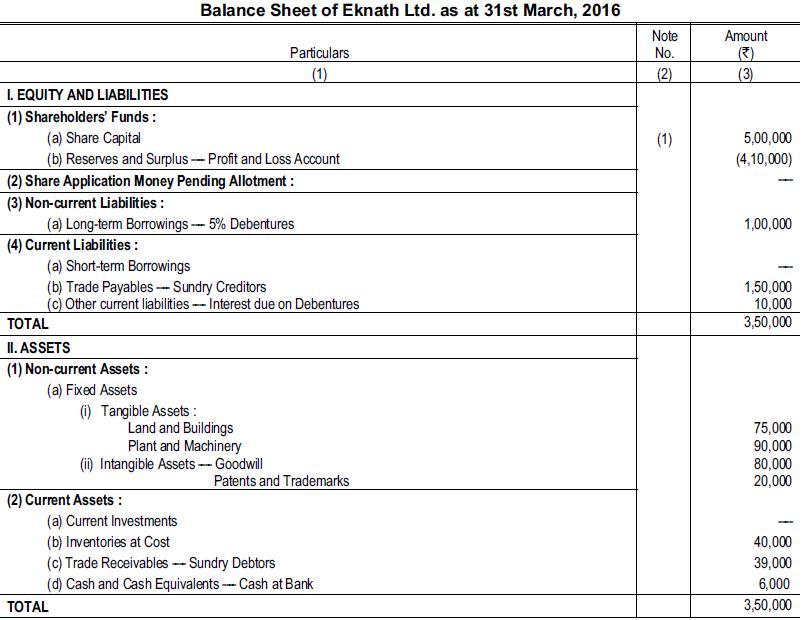

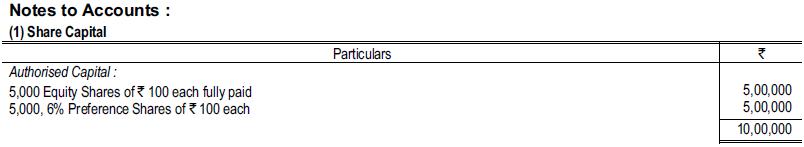

Following is the Balance Sheet of Eknath & Co. Ltd. as on 31.3.2016: It is believed that

Question:

Following is the Balance Sheet of Eknath & Co. Ltd. as on 31.3.2016:

It is believed that the worst is over and that the time has arrived to effect reconstruction. A revaluation of assets reveals the following :

Land and Buildings ₹ 95,000; Plant and Machinery ₹ 1,12,000; Patents and Trademarks ₹ 5,000; Inventories ₹ 25,000; Debtors ₹ 32,000.

The following scheme is framed and approved by the Tribunal :

(1) The preference shares be converted into 7.5% preference shares of ₹ 30 each fully paid.

(2) The equity shares be converted into shares of ₹ 5 each fully paid.

(3) The sundry creditors be given the option to either accept 50% of their claims in cash in full satisfaction or to convert their claims into equity shares of ₹ 5 each.

(4) The revaluation of assets be adopted. One-third (in value) of the creditors accepted equity shares for their claims. The rent was paid cash which was raised by issuing 17,000 fully paid equity shares to the existing equity shareholders. All shares including preference shares were then consolidated (or sub-divided) into equity shares of ₹ 10 each. In view of the unsatisfactory state of affairs of the company the debentureholders agreed to forego the interest due on debentures. Pass journal entries and prepare the Balance Sheet, after the scheme is put into effect.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee