H Ltd purchased 13,500 shares of S Ltd on 01.07.2012 at a cost of 2,10,000. Following

Question:

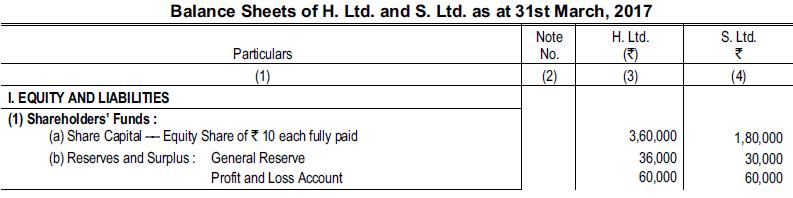

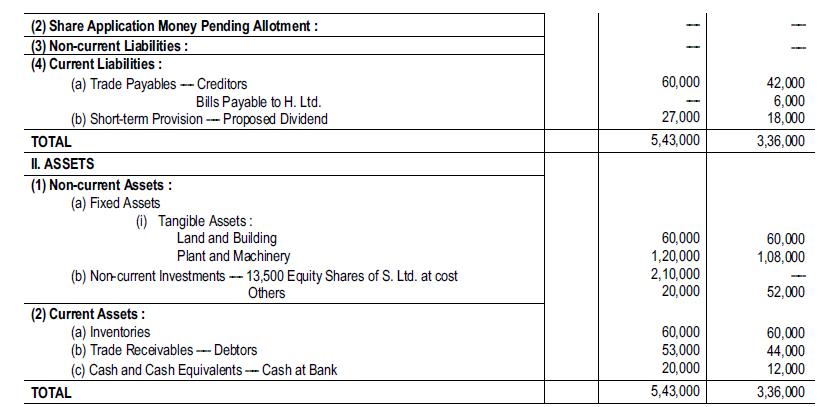

H Ltd purchased 13,500 shares of S Ltd on 01.07.2012 at a cost of ₹ 2,10,000. Following are the Balance Sheets of two companies as at 31.03.2017:

Other information:

(a) S Ltd had on 1.4.2016 ₹ 18,000 in General Reserve and ₹ 36,000 (Cr.) in Profit and Loss Account.

(b) In September 2016, S Ltd paid a dividend for the year 2015-16. H Ltd received ₹ 15,000 of such dividend and credited the same to its Investment Account.

(c) Plant and Machinery standing in the books of S Ltd at ₹ 1,20,000 on 01.04.2016 was revalued at ₹ 1,40,000 on the date of acquisition of shares. No addition or sale of machinery was made during the year.

(d) Stock of S Ltd included ₹ 9,600 purchased from H Ltd on which H Ltd made a profit of 20% on cost. Prepare Consolidated Balance Sheet of H Ltd with its subsidiary S Ltd as on 31.03.2017.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee