The following is the summarised Balance Sheet of AB Ltd. as on 31st March, 2016: (a) There

Question:

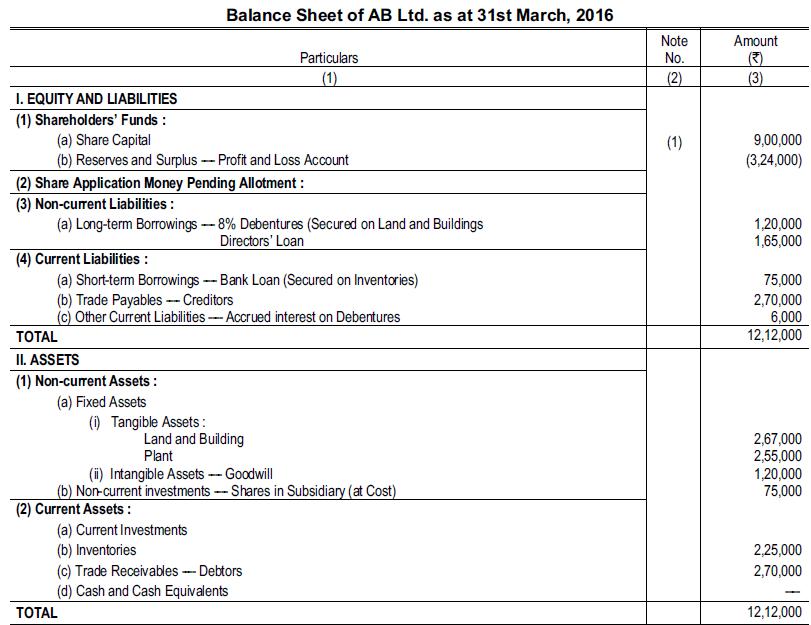

The following is the summarised Balance Sheet of AB Ltd. as on 31st March, 2016:

(a) There is a contingent liability of ₹ 30,000.

(b) Preference shares are cumulative and dividends are in arrear for three years. A capital reduction scheme stating the following terms was duly approved:

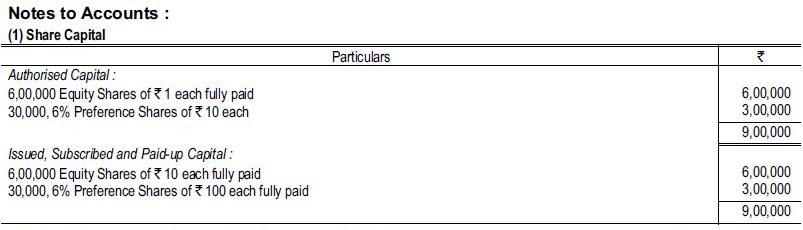

(i) The preference shares to be reduced to ₹ 8 per share and the equity shares to 25 paise each and to be consolidated as shares of ₹ 10 each and Re 1 each fully paid respectively. The preference shareholders waive two-thirds of dividend arrear and receive equity shares for the balance. The authorised capital to be restored to ₹ 30,000 preference shares of ₹ 10 each and 6,00,000 equity shares of Re 1 each.

(ii) The shares in Subsidiary Ltd. are sold to an outside interest for ₹1,50,000.

(iii) All intangible assets are to be eliminated and bad debts of ₹12,000 and obsolete stock of ₹30,000 to be written off.

(iv) The debentureholders to take over one of company’s properties (book value ₹54,000) at a price of ₹60,000 in part satisfaction of the debentures and to provide further cash of ₹45,000 on a floating charge. The arrears of interest are paid.

(v) The contingent liability materialised in the sum stated but the company recovered ₹15,000 of these damages in action against one of its directors. This was debited to his loan account of ₹24,000, the balance of which was paid in cash on his resignation.

(vi) The remaining directors agreed to take equity shares in satisfaction of their loans. You are required to:

(i) Give the necessary Journal Entries including cash transactions;

(ii) Set out the revised Balance Sheet after giving effect to the foregoing entries.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee