X and Y who were working as partners formed a limited company in the name of XY(P)

Question:

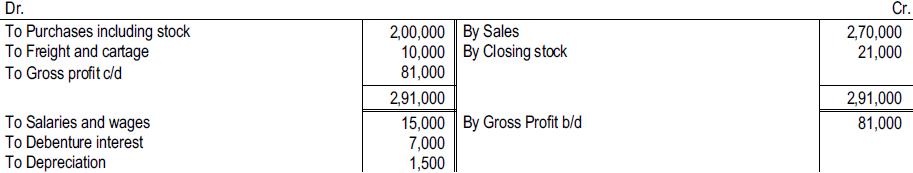

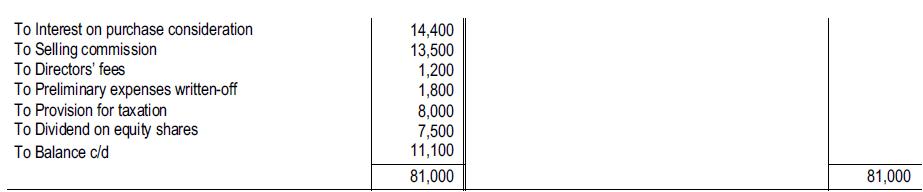

X and Y who were working as partners formed a limited company in the name of XY(P) Ltd, on 1st June, 2016 to take over their existing business, with the consideration being a sum of ₹ 4,80,000 and the condition that until the amount was discharged, they would pay interest @6% p.a. from 1st January, 2016. The amount was paid on June 30, 2016. To discharge the purchase consideration, the company issued 30,000 Equity Shares of ~ 10 each at a premium of ₹ 1 each for cash and allotted 7% Debentures of the face value of ₹ 2,00,000 to the vendors at par. The following was the Profit and Loss Account of XY (P) Ltd for the year ended 31.12.2016.

You are required to prepare a statement apportioning the balance between the post- and pre-incorporation periods assuming that the sales in the post-incorporation period were double the same in the pre-incorporation period. Show how these figures would appear in the Balance Sheet of XY (P) Ltd.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee