The Citrix Fund has invested in a portfolio of government bonds that has a current market value

Question:

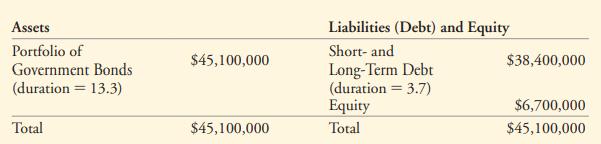

The Citrix Fund has invested in a portfolio of government bonds that has a current market value of $45.1 million. The duration of this portfolio of bonds is 13.3 years. The fund has borrowed to purchase these bonds, and the current value of its liabilities (i.e., the current value of the bonds it has issued) is $38.4 million. The duration of these liabilities is 3.7 years. The equity in the Citrix Fund (or its net worth) is obviously $6.7 million. The market-value balance sheet below summarizes this information:

Assume that the current yield curve is flat at 5.9%. You have been hired by the board of directors to evaluate the risk of this fund.

a. Consider the effect of a surprise increase in interest rates, such that the yields rise by 50 basis points (i.e., the yield curve is now flat at 6.4%). What would happen to the value of the assets in the Citrix Fund? What would happen to the value of the liabilities? What can you conclude about the change in the value of the equity under these conditions?

b. What is the initial duration of the Citrix Fund (i.e., the duration of the equity)?

c. As a result of your analysis, the board of directors fires the current manager of the fund. You are hired and given the objective of minimizing the fund’s exposure to interest rate fluctuations.

You are instructed to do so by liquidating a portion of the fund’s assets and reinvesting the proceeds in short-term Treasury bills and notes with an average duration of two years. How many dollars do you need to liquidate and reinvest to minimize the fund’s interest rate sensitivity?

d. Rather than immunizing the fund using the strategy in part (c), you consider using a swap contract. If the duration of a 10-year, fixed-coupon bond is seven years, what is the notational amount of the swap you should enter into? Should you receive or pay the fixed-rate portion of the swap?

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo