Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for

Question:

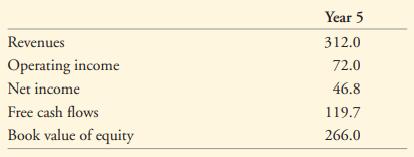

Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for this division for the next five years, and have estimated that the cost of capital is 11%. You would like to estimate a continuation value. You have made the following forecasts for the last year of your five-year forecasting horizon (in millions of dollars):

a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5, using the perpetuity with growth formula.

b. You have identified several firms in the same industry as your operating division. The average P/E ratio for these firms is 24. Estimate the continuation value assuming the P/E ratio for your division in year 5 will be the same as the average P/E ratio for the comparable firms today.

c. The average market/book ratio for the comparable firms is 3.6. Estimate the continuation value using the market/book ratio.

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo