Your utility company will need to buy 115,000 barrels of oil in 10 days time, and it

Question:

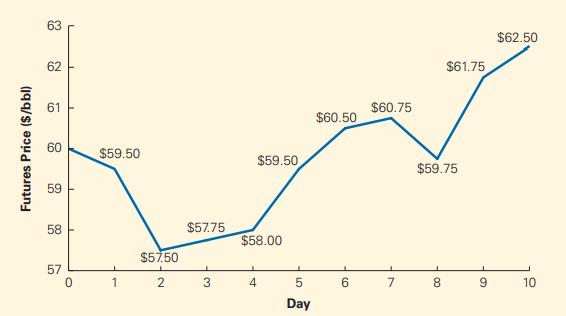

Your utility company will need to buy 115,000 barrels of oil in 10 days’ time, and it is worried about fuel costs. Suppose you go long 115 oil futures contracts, each for 1000 barrels of oil, at the current futures price of $60 per barrel. Suppose futures prices change each day as follows:

a. What is the mark-to-market profit or loss (in dollars) that you will have on each date?

b. What is your total profit or loss after 10 days? Have you been protected against a rise in oil prices?

c. What is the largest cumulative loss you will experience over the 10-day period? In what case might this be a problem?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo

Question Posted: