In the previous problem, suppose the firm was operating at only 85 percent capacity in 2020. What

Question:

In the previous problem, suppose the firm was operating at only 85 percent capacity in 2020. What is EFN now?

Data from Previous Problem

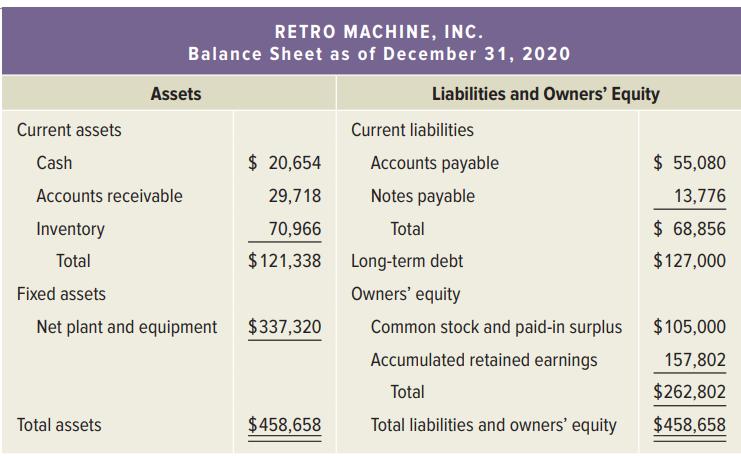

The most recent financial statements for Retro Machine, Inc., follow. Sales for 2021 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what is the external financing needed to support the 20 percent growth rate in sales?

RETRO MACHINE INC.

2020 Income Statement

Sales ...............................................................$683,520

Costs ................................................................567,240

Other expenses ...............................................17,320

Earnings before interest and taxes ...........$ 98,960

Interest paid ....................................................15,780

Taxable income ...........................................$ 83,180

Taxes (21%) .....................................................17,468

Net income ..................................................$ 65,712

Dividends .....................................................$ 22,719

Addition to retained earnings ......................42,993

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan