Use Figure 20.1 to answer the following questions. Suppose interest rate parity holds, and the current six-month

Question:

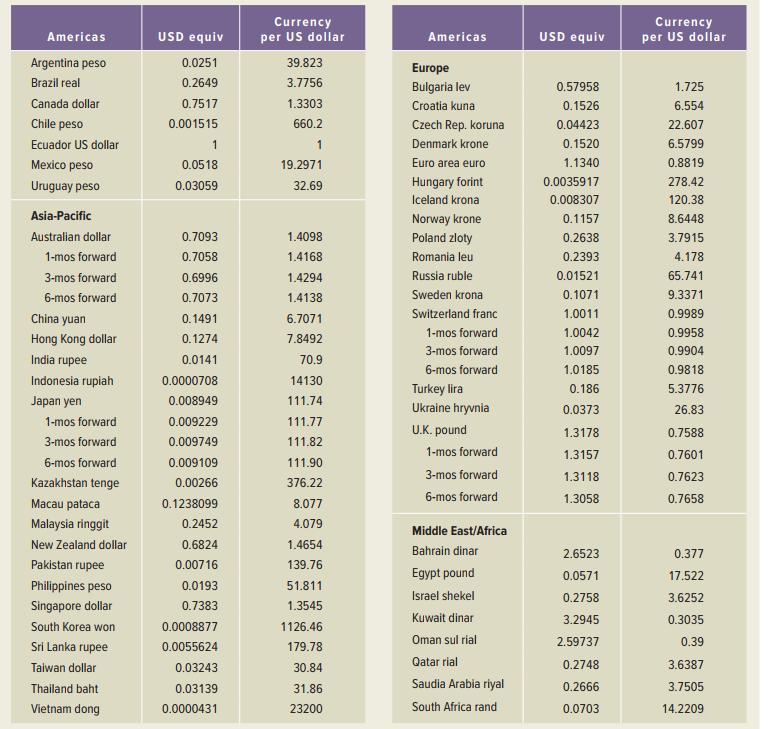

Use Figure 20.1 to answer the following questions. Suppose interest rate parity holds, and the current six-month risk-free rate in the United States is 1.9 percent. What must the six month risk-free rate be in Great Britain? In Japan? In Switzerland?

Transcribed Image Text:

Currency USD equiv per US dollar USD equiv Currency per US dollar Americas Americas Argentina peso 0.0251 39.823 Europe Brazil real 0.2649 3.7756 Bulgaria lev 0.57958 1.725 Canada dollar 0.7517 1.3303 Croatia kuna 0.1526 6.554 Chile peso 0.001515 660.2 Czech Rep. koruna 0.04423 22.607 Ecuador US dollar 1 1 Denmark krone 0.1520 6.5799 Mexico peso 0.0518 19.2971 Euro area euro 1.1340 0.8819 Uruguay peso Hungary forint 0.0035917 278.42 0.03059 32.69 Iceland krona 0.008307 120.38 Asia-Pacific Norway krone 0.1157 8.6448 Australian dollar 0.7093 1.4098 Poland zloty 0.2638 3.7915 1-mos forward 0.7058 1.4168 Romania leu 0.2393 4.178 3-mos forward 0.6996 1.4294 Russia ruble 0.01521 65.741 6-mos forward 0.7073 1.4138 Sweden krona 0.1071 9.3371 Switzerland franc 1.0011 0.9989 China yuan 0.1491 6.7071 1-mos forward 1.0042 0.9958 Hong Kong dollar 0.1274 7.8492 3-mos forward 1.0097 0.9904 India rupee 0.0141 70.9 6-mos forward 1.0185 0.9818 Indonesia rupiah 0.0000708 14130 Turkey lira Ukraine hryvnia 0.186 5.3776 Japan yen 0.008949 111.74 0.0373 26.83 1-mos forward 0.009229 111.77 U.K. pound 1.3178 0.7588 3-mos forward 0.009749 111.82 1-mos forward 1.3157 0.7601 6-mos forward 0.009109 111.90 3-mos forward 1.3118 0.7623 Kazakhstan tenge 0.00266 376.22 6-mos forward 1.3058 0.7658 Macau pataca 0.1238099 8.077 Malaysia ringgit 0.2452 4.079 Middle East/Africa New Zealand dollar 0.6824 1.4654 Bahrain dinar 2.6523 0.377 Pakistan rupee 0.00716 139.76 Egypt pound 0.0571 17.522 Philippines peso 0.0193 51.811 Israel shekel 0.2758 3.6252 Singapore dollar 0.7383 1.3545 Kuwait dinar 3.2945 0.3035 Suth Korea won 0.0008877 1126.46 Oman sul rial 2.59737 0.39 Sri Lanka rupee 0.0055624 179.78 Taiwan dollar 0.03243 30.84 Qatar rial 0.2748 3.6387 Thailand baht 0.03139 31.86 Saudia Arabia riyal 0.2666 3.7505 Vietnam dong 0.0000431 23200 South Africa rand 0.0703 14.2209

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

We can rearrange the interest rate parity condition to answer t...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Use the diagram to answer the following questions (ad). a. At the equilibrium price before the tax is imposed, what area represents consumer surplus? What area represents producer surplus? b. Say...

-

Use WestlawNext Campus Research to answer the following questions regarding the Jensen 178 Cal. App. 4th 426 case: a. In what year was the case decided and by what court? b. Examine the headnote....

-

Use the CCH IntelliConnect Citator to answer the following questions regarding Notice 2010-10: a. Where is the notice located in the Internal Revenue Bulletin? b. Where is the notice annotated? c....

-

Demonstrate competency in the behavioral finance you are required to complete the following learning demonstration. 1. Executive summary 2) A numeric example demonstrating violations of expected...

-

Describe how the mean compares to the median for a distribution as follows: a. Skewed to the left b. Skewed to the right c. Symmetric

-

Orange Designs provides consulting services related to home decoration. Orange Designs provides customers with recommendations for a full range of home d?cor, including window treatments, carpet and...

-

The value(s) closed during compression stroke of an I.C. engine is/are (a) Inlet (b) Exhaust (c) Both inlet and exhaust (d) none of the above

-

As part of your systems analysis project to update the automated accounting functions for Xanadu Corporation, a maker of digital cameras, you will interview Leo Blum, the chief accountant. Write four...

-

The preceding section reveals that management accounting has evolved parallel with the development of technology and business environment. It is apparent that management accounting information has...

-

On April 5, 2020, Javier Sanchez purchased and placed in service a new 7-year class asset costing $340,400 for use in his landscaping business, which he operates as a single member LLC (Sanchez...

-

The treasurer of a major U.S. firm has $30 million to invest for three months. The interest rate in the United States is .39 percent per month. The interest rate in Great Britain is .41 percent per...

-

Suppose the Japanese yen exchange rate is 105 = $1, and the British pound exchange rate is 1 = $1.34. a. What is the cross-rate in terms of yen per pound? b. Suppose the cross-rate is 136 = 1. Is...

-

What is the difference between accounting theory and accounting research?

-

Color conversion. Several different formats are used to represent color. For example, the primary format for LCD displays, digital cameras, and web pages, known as the RGB format, specifies the level...

-

Dragon curves. Write a program to print the instructions for drawing the dragon curves of order 0 through 5. The instructions are strings of F, L, and R characters, where F means draw line while...

-

Inverse permutation. Write a program that reads in a permutation of the integers 0 to n-1 from n command-line arguments and prints the inverse permutation. (If the permutation is in an array a[], its...

-

Random web. Write a generator for Transition that takes as commandline arguments a page count n and a link count m and prints to standard output n followed by m random pairs of integers from 0 to...

-

Write a program that prints the sum of two random integers between 1 and 6 (such as you might get when rolling dice).

-

Intercompany transactions between Pop Corporation and Son Corporation, its 80 percent-owned subsidiary, from January 2016, when Pop acquired its controlling interest, to December 31, 2019, are...

-

Quadrilateral EFGH is a kite. Find mG. E H <105 G 50 F

-

Office Automation, Inc., must choose between two copiers, the XX40 or the RH45. The XX40 costs $1,499 and will last for three years. The copier will require a real aftertax cost of $120 per year...

-

Dickinson Brothers, Inc., is considering investing in a machine to produce computer keyboards. The price of the machine will be $975,000, and its economic life is five years. The machine will be...

-

Aday Acoustics, Inc., projects unit sales for a new seven-octave voice emulation implant as follows: Year .....................Unit Sales 1.............................. 81,000...

-

Clara a CPA, has been engaged by nonissuer Baxter Manufacturing Co. to perform a financial statement audit. During the audit, Clara identified a control deficiency that was a significant deficiency...

-

The following standard cost statement relates to a product which sells for $200 each. The company budgets to produce and sell 4,000 units. The variable overhead costs per unit are $120 and the fixed...

-

We are going to be spending a lot of time together, Michael, so I think we need to make the best of it." There was an underlying tone of parental condescension in Emma Nelson's voice as she spoke to...

Study smarter with the SolutionInn App