Both a default-free, two-year government bond and a two-year corporate bond pay a 7 percent coupon. However,

Question:

Both a default-free, two-year government bond and a two-year corporate bond pay a 7 percent coupon. However, the government bond sells at par (or $l,000) and the corporate bond sells at $982.16. What are the yields on these two bonds? Why is there a difference in yields? Are these yields promised yields? Assume annual coupon payments.

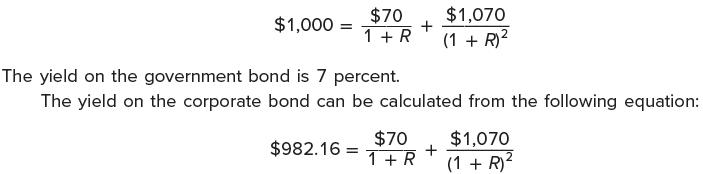

Both bonds pay a coupon of $70 per year. The yield on the government bond can be calculated from the following equation:

The yield on the corporate bond is 8 percent.

The yield on the government bond is below that on the corporate bond because the corporate bond has default risk, while the government bond does not.

For both bonds, the yields we calculated are promised yields because the coupons are promised coupons. These coupons will not be paid in full if there is a default. The promised yield is equal to the expected return on the government bond because there is no chance of default. However, the promised yield is greater than the expected return on the corporate bond because default is a possibility.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe