Consider Supertech and Slowpoke. From our earlier calculations, we find that the expected returns on these two

Question:

Consider Supertech and Slowpoke. From our earlier calculations, we find

that the expected returns on these two securities are 17.5 percent and 5.5 percent, respectively.

The expected return on a portfolio of these two securities alone can be written as:![]()

where X Super is the percentage of the portfolio in Supertech and XSlow is the percentage of the

portfolio in Slowpoke. If the investor with $100 invests $60 in Supertech and $40 in Slowpoke,

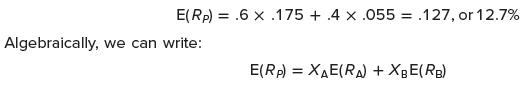

the expected return on the portfolio can be written as:

where X A and XB are the proportions of the total portfolio in the assets A and B, respectively.

(Because our investor can invest in only two securities, XA + XB must equal 1, or 100 percent.) E(RA) and E(RB) are the expected returns on the two securities.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe