Danielle Caravello will receive a four-year annuity of $500 per year, with the first payment at Year

Question:

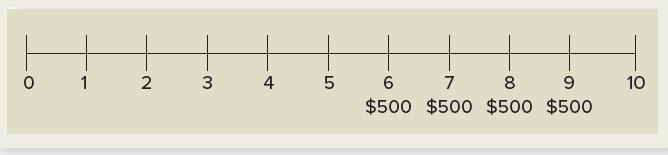

Danielle Caravello will receive a four-year annuity of $500 per year, with the first payment at Year 6. If the discount rate is 10 percent, what is the value of her annuity today? The timeline for the cash flows is:

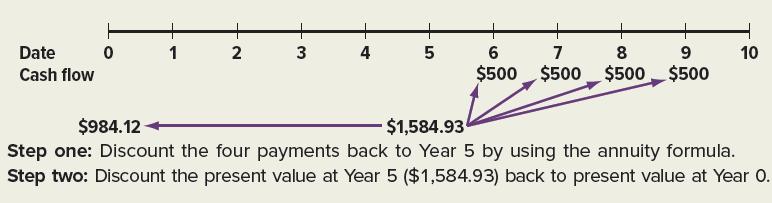

The analysis involves two steps:

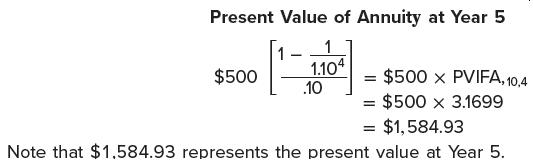

1. Calculate the present value of the annuity using Equation 4.15:

Students frequently think that $1,584.93 is the present value at Year 6 because the first payment is at Year 6. However, our formula values the annuity as of one period prior to the first payment. This can be seen in the most typical case where the first payment occurs at Year 1.

The formula values the annuity as of Year 0 in that case.

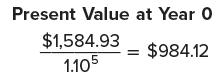

2. Discount the present value of the annuity back to Year 0:

Again, it is worthwhile mentioning that because the annuity formula brings Danielle’s annuity back to Year 5, the second calculation must discount over the remaining five periods. The two-step procedure is shown in Figure 4.12. Discounting Danielle Caravello’s Annuity

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe