Divided Airlines is currently an unlevered firm. The company expects to generate $126.6 in earnings before interest

Question:

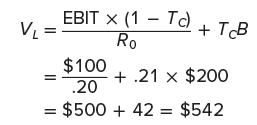

Divided Airlines is currently an unlevered firm. The company expects to generate $126.6 in earnings before interest and taxes (EBIT) in perpetuity. The corporate tax rate is 21 percent, implying aftertax earnings of $100. All earnings after tax are paid out as dividends.

The firm is considering a capital restructuring to allow $200 of debt. Its cost of debt capital is 10 percent. Unlevered firms in the same industry have a cost of equity capital of 20 percent.

What is the new value of Divided Airlines?

The value of Divided Airlines will be equal to:

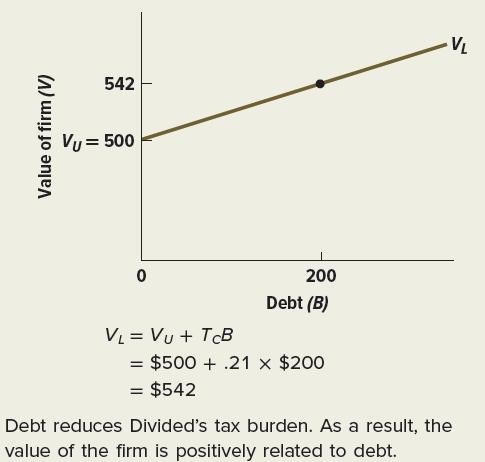

The value of the levered firm is $542, which is greater than the unlevered value of $500.

Because V L = B + S, the value of levered equity, S, is equal to $542 − 200 = $342. The value of Divided Airlines as a function of leverage is illustrated in Figure 16.5. Figure 16.5 The Effect of Financial Leverage on Firm Value: MM with Corporate Taxes in the Case of Divided Airlines

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe