On March 2, 2000, 3Com, a profitable provider of computer networking products and services, sold 5 percent

Question:

On March 2, 2000, 3Com, a profitable provider of computer networking products and services, sold 5 percent of one of its subsidiaries, Palm, to the public via an initial public offering (IPO). 3Com planned to distribute the remaining Palm shares to 3Com shareholders at a later date. Under the plan, if you owned one share of 3Com, you would receive 1.5 shares of Palm. So after 3Com sold part of Palm via the IPO, investors could buy Palm shares directly or indirectly by purchasing shares of 3Com and waiting.

What makes this case interesting is what happened in the days that followed the Palm IPO.

If you owned one 3Com share, you would be entitled, eventually, to 1.5 shares of Palm. Therefore, each 3Com share should be worth at least 1.5 times the value of each Palm share. We say at least because the other parts of 3Com were profitable. As a result, each 3Com share should have been worth much more than 1.5 times the value of one Palm share. But as you might guess, things did not work out this way.

The day before the Palm IPO, shares in 3Com sold for $104.13. After the first day of trading, Palm closed at $95.06 per share. Multiplying $95.06 by 1.5 results in $142.59, which is the minimum value we would expect to pay for 3Com. But the day Palm closed at $95.06, 3Com shares closed at $81.81, more than $60 lower than the price implied by Palm.

A 3Com price of $81.81 when Palm was selling for $95.06 implies that the market valued the rest of 3Com’s businesses (per share) at $81.81 − 142.59 = − $60.78. Given the number of 3Com shares outstanding at the time, this means the market placed a negative value of about $22 billion on the rest of 3Com’s businesses. Of course, a stock price cannot be negative. This means that the price of Palm relative to 3Com was much too high.

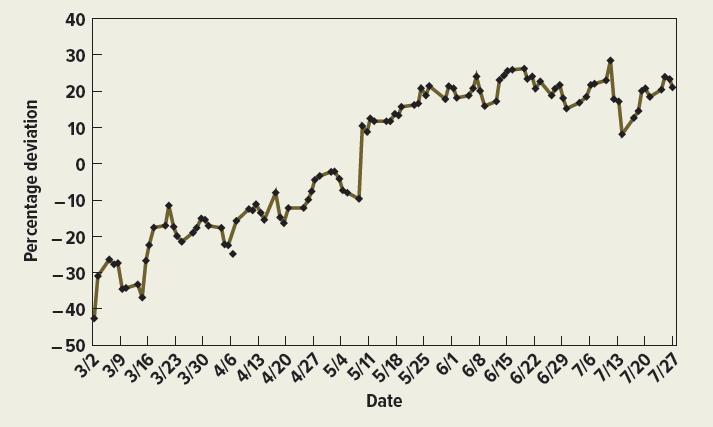

To profit from this mispricing, investors would purchase shares of 3Com and sell shares of Palm. This trade was a no-brainer. In a well-functioning market, arbitrage traders would force the prices into alignment quickly. What happened? Figure 14.8 The Percentage Difference between One Share of 3Com and One and One-Half Shares of Palm, March 2, 2000, to July 27, 2000

As you can see in Figure 14.8, the market valued 3Com and Palm shares in such a way that the non-Palm part of 3Com had a negative value for about two months from March 2, 2000, until May 8, 2000. Thus, the pricing error was corrected by market forces, but not instantly, which is consistent with the existence of limits to arbitrage.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe