Paige Ouimet wants to buy a tugboat today. Rather than paying immediately, she offers to pay $150,000

Question:

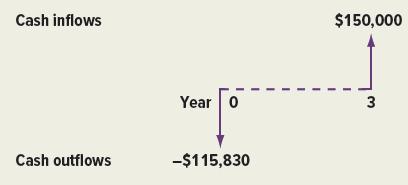

Paige Ouimet wants to buy a tugboat today. Rather than paying immediately, she offers to pay $150,000 in three years. It will cost Tugboat Corp. $115,830 to build the tugboat immediately. The relevant cash flows to Tugboat Corp. are displayed in Figure 4.10.

What interest rate should Tugboat Corp. charge to neither gain nor lose on the sale? Cash Flows for Tugboat

The ratio of construction cost (present value) to sale price (future value) is:![]()

We must determine the interest rate that allows $1 to be received in three years to have a present value of $.7722. Table A.1 tells us that 9 percent is that interest rate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: