Stanley Jaffe and Sherry Lansing have purchased the rights to Corporate Finance: The Motion Picture. They will

Question:

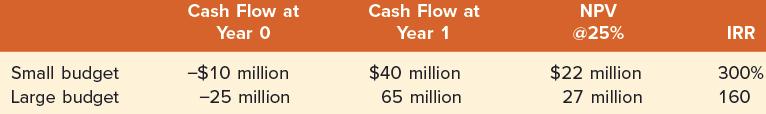

Stanley Jaffe and Sherry Lansing have purchased the rights to Corporate Finance: The Motion Picture. They will produce this major motion picture on either a small budget or a large budget. Here are the estimated cash flows:

Because of high risk, a 25 percent discount rate is considered appropriate. Sherry wants to adopt the large budget because the NPV is higher. Stanley wants to adopt the small budget because the IRR is higher. Who is right?

For the reasons explained in the classroom example, NPV is correct. Hence, Sherry is right.

However, Stanley is very stubborn where IRR is concerned. How can Sherry justify the large budget to Stanley using the IRR approach?

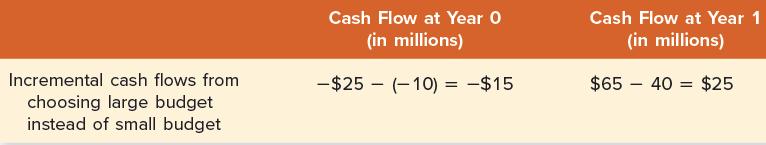

This is where incremental IRR comes in. Sherry calculates the incremental cash flows from choosing the large budget instead of the small budget as follows:

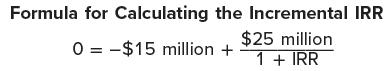

This chart shows that the incremental cash flows are −$15 million at Year 0 and $25 million at Year 1. Sherry calculates incremental IRR as follows:

IRR equals 66.67 percent in this equation, implying that the incremental IRR is 66.67 percent.

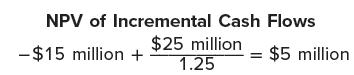

Incremental IRR is the IRR on the incremental investment from choosing the large project instead of the small project. In addition, we can calculate the NPV of the incremental cash flows:

We know the small-budget picture would be acceptable as an independent project because its NPV is positive. We want to know whether it is beneficial to invest an additional $15 million to make the large-budget picture instead of the small-budget picture. In other words, is it beneficial to invest an additional $15 million to receive an additional $25 million next year? First, our calculations show the incremental NPV to be positive. Second, the incremental IRR of 66.67 percent is higher than the discount rate of 25 percent. For both reasons, the incremental investment can be justified, so the large-budget movie should be made. The second reason is what Stanley needed to hear to be convinced.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe