Stuart Gabriel, a second-year MBA student, has been offered a job at $80,000 a year. He anticipates

Question:

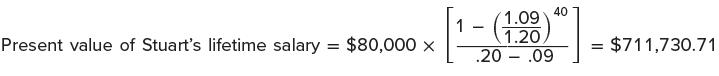

Stuart Gabriel, a second-year MBA student, has been offered a job at $80,000 a year. He anticipates his salary will increase by 9 percent a year until his retirement in 40 years. Given a discount rate of 20 percent, what is the present value of his lifetime salary?

We simplify by assuming he will be paid his $80,000 salary exactly one year from now and that his salary will continue to be paid in annual installments. The appropriate discount rate is 20 percent. From Equation 4.17, the calculation is:

Though the growing annuity formula is quite useful, it is more tedious than the other simplifying formulas. Whereas most financial calculators have special programs for a perpetuity, a growing perpetuity, and an annuity, there is no special program for a growing annuity. Hence, we must calculate all the terms in Equation 4.17 directly.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe