Suppose that the Kaufold Corporation has two alternative uses for a warehouse. It can store toxic waste

Question:

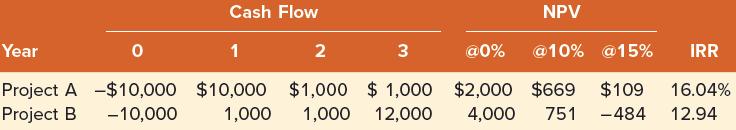

Suppose that the Kaufold Corporation has two alternative uses for a warehouse. It can store toxic waste containers (Project A) or electronic equipment (Project B). The cash flows are as follows:

We find that the NPV of Project B is higher with low discount rates, and the NPV of Project A is higher with high discount rates. This is not surprising if you look closely at the cash flow patterns.

The larger cash flows of A occur early, whereas the larger cash flows of B occur later. With the time value of money, earlier cash flows are less affected by higher discount rates, so A’s Year 1 cash flow is more valuable. Because Project B’s cash flows are greater, B’s value is relatively high with low discount rates because the cost of waiting on the larger cash flows is lower.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe