Suppose you are expecting to receive a million British pounds in six months, and you agree to

Question:

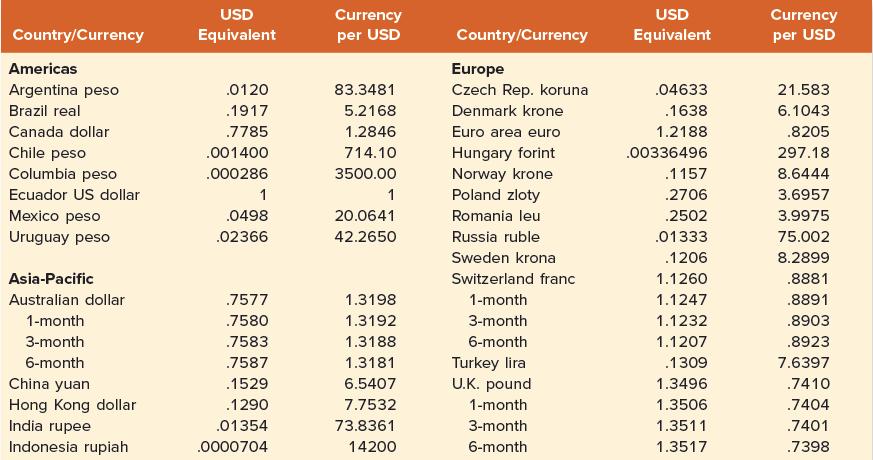

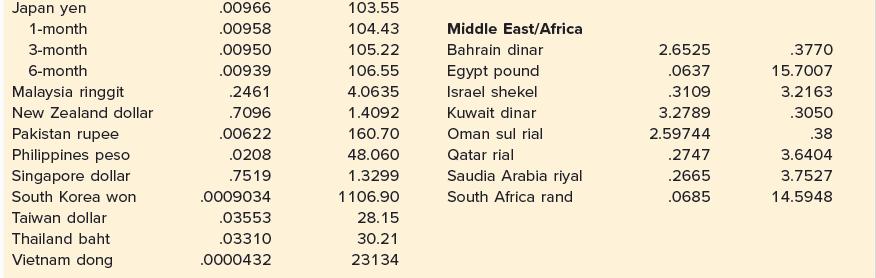

Suppose you are expecting to receive a million British pounds in six months, and you agree to a forward trade to exchange your pounds for dollars. Based on Figure 31.1, how many dollars will you get in six months? Is the pound selling at a discount or a premium relative to the dollar? In Figure 31.1, the spot exchange rate and the 180-day forward rate in terms of dollars per pound are $1.3496 and $1.3517, respectively. If you expect £1 million in 180 days, then you will get £1 million × $1.3517 per pound = $1.3517 million. Because it is more expensive to buy a pound in the forward market than in the spot market ($1.3517 versus $1.3496), the pound is said to be selling at a premium relative to the dollar.

Figure 31.1

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe