The J. Lowes Corporation, which currently manufactures staples, is considering a $1 million investment in a project

Question:

The J. Lowes Corporation, which currently manufactures staples, is considering a $1 million investment in a project in the aircraft adhesives industry. The corporation estimates unlevered aftertax cash flows (UCF) of $300,000 per year into perpetuity from the project. The firm will finance the project with a debt-value ratio of .5 (or, equivalently, a debt-equity ratio of 1.0).

The three competitors in this new industry are currently unlevered, with betas of 1.2, 1.3, and 1.4. Assuming a risk-free rate of 5 percent, a market risk premium of 9 percent, and a corporate tax rate of 21 percent, what is the net present value of the project?

We can answer this question in five steps.

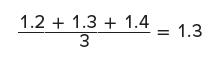

1. Calculating the average unlevered beta in the industry: The average unlevered beta across all three existing competitors in the aircraft adhesives industry is:

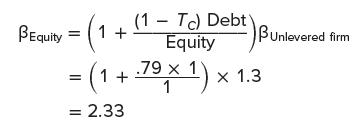

2. Calculating the levered beta for J. Lowes’s new project: Assuming the same unlevered beta for this new project as for the existing competitors, we have, from Equation 18.4:

3. Calculating the cost of levered equity for the new project: We calculate the discount rate by applying the CAPM to the levered beta:![Rs RF + B x [E(RM) - RF] = .05 +2.33 x .09 = .2594, or 25.94%](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/5/291655c430b06f741700545290654.jpg)

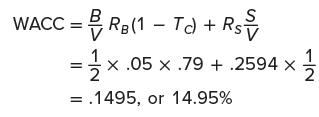

4. Calculating the WACC for the new project: The formula for determining the weighted average cost of capital is:

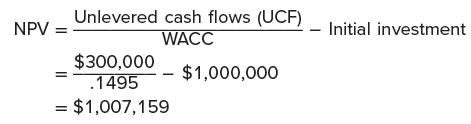

5. Determining the project’s value: Because the cash flows are perpetual, the NPV of the project is:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe