To see how warrants affect the value of the firm, imagine that Mr. Gould and Ms. Rockefeller

Question:

To see how warrants affect the value of the firm, imagine that Mr. Gould and Ms. Rockefeller are two investors who have together purchased six ounces of platinum. At the time they bought the platinum, Mr. Gould and Ms. Rockefeller each contributed half of the cost, which we will assume was $3,000 for six ounces, or $500 an ounce (they each contributed $1,500). They incorporated, printed two stock certificates, and named the firm the GR Company. Each certificate represents a one-half claim to the platinum. Mr. Gould and Ms. Rockefeller each own one certificate. They have formed a company with platinum as its only asset.

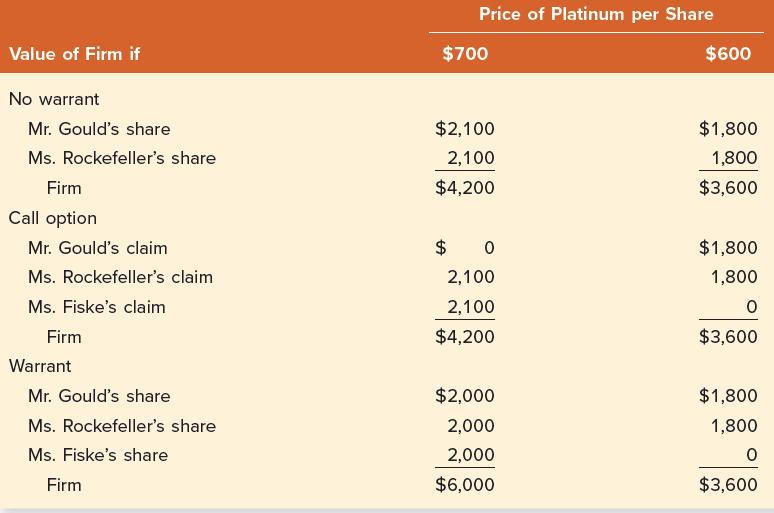

A Call Is Issued Suppose Mr. Gould later decides to sell to Ms. Fiske a call option issued on Mr. Gould’s share. The call option gives Ms. Fiske the right to buy Mr. Gould’s share for $1,800 within the next year. If the price of platinum rises above $600 per ounce, the firm will be worth more than $3,600, and each share will be worth more than $1,800. If Ms. Fiske decides to exercise her option, Mr. Gould must turn over his stock certificate and receive $1,800.

How would the firm be affected by the exercise? The number of shares will remain the same. There will still be two shares, now owned by Ms. Rockefeller and Ms. Fiske. If the price of platinum rises to $700 an ounce, each share will be worth $2,100 (= $4,200 / 2 ) . If Ms. Fiske exercises her option at this price, she will gain $300.

A Warrant Is Issued Instead This story changes if a warrant is issued. Suppose that Mr. Gould does not sell a call option to Ms. Fiske. Instead, Mr. Gould and Ms. Rockefeller have a stockholders’

meeting. They vote that GR Company will issue a warrant and sell it to Ms. Fiske. The warrant will give Ms. Fiske the right to receive a share of the company at an exercise price of $1,800.3 If Ms. Fiske decides to exercise the warrant, the firm will issue another stock certificate and give it to Ms. Fiske in exchange for $1,800. From Ms. Fiske’s perspective, the call option and the warrant seem to be the same. The exercise prices of the warrant and the call are the same: $1,800. It is still advantageous for Ms.

Fiske to exercise the warrant when the price of platinum exceeds $600 per ounce. However, we will show that Ms. Fiske actually makes less in the warrant situation due to dilution.

The GR Company also must consider dilution. Suppose the price of platinum increases to $700 an ounce and Ms. Fiske exercises her warrant. Two things will occur:

1. Ms. Fiske will pay $1,800 to the firm.

2. The firm will print one stock certificate and give it to Ms. Fiske. The stock certificate will represent a one-third claim on the value of the firm.

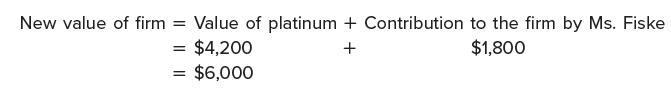

Because Ms. Fiske contributes $1,800 to the firm, the value of the firm increases. It is now worth:

Because Ms. Fiske has a one-third claim on the firm’s value, her share is worth $2,000 ( = $6,000 / 3 ) . By exercising the warrant, Ms. Fiske gains $2,000 − 1,800 = $200 . This is illustrated in Table 24.1.

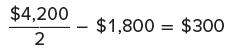

Why does Ms. Fiske gain only $200 in the warrant case but $300 in the call option case? The key is share price dilution, as we discussed in an earlier chapter. GR Company has issued another share in exchange for less than market value, leading to a decline in the share price. In the call option case, she contributes $1,800 and receives one of the two outstanding shares. That is, she receives a share worth $2,100 (= 1 / 2 × $4,200 ) . Her gain is $300 (= $2,100 − 1,800 ) . We rewrite this gain like this:

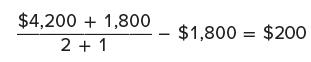

In the warrant case, she contributes $1,800 and receives a newly created share. She now owns one of the three outstanding shares. Because the $1,800 remains in the firm, her share is worth $2,000 [ = ( $4,200 + 1,800 ) / 3 ] . Her gain is $200 (= $2,000 − 1,800) . We rewrite this gain as follows:

Warrants also affect accounting numbers. Warrants and (as we will see) convertible bonds cause the number of shares to increase. This causes the firm’s net income to be spread over more shares, thereby decreasing earnings per share. Firms with significant amounts of warrants and convertible issues must report earnings on a primary basis and a fully diluted basis.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe