We follow on from the last example and repeat our earlier calculation with semiannual interest payments of

Question:

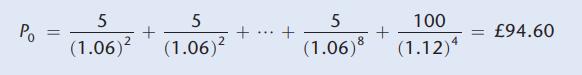

We follow on from the last example and repeat our earlier calculation with semiannual interest payments of £5 discounted at a six-monthly required rate of return of 6 per cent (half of the 12 per cent required return by the investors). The theoretical market value now becomes:

The increase in theoretical market value occurs because half of each year’s interest payment is received sooner and therefore it has a higher present value.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted: