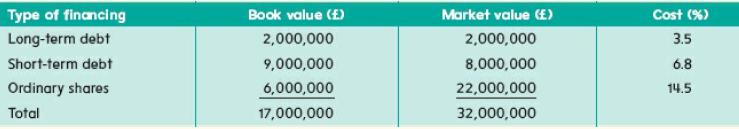

Bolero plc has compiled the following information on its financing costs: The company is in the 28

Question:

Bolero plc has compiled the following information on its financing costs:

The company is in the 28 per cent tax bracket and has a target debt–equity ratio of 60 per cent.

The target short-term debt/long-term debt ratio is 20 per cent.

(a) What is the company’s weighted average cost of capital using book value weights?

(b) What is the company’s weighted average cost of capital using market value weights?

(c) What is the company’s weighted average cost of capital using target capital structure weights?

(d) What is the difference between WACCs? Which is the correct WACC to use for project evaluation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted: