Gentley plc and Rolls Manufacturing are considering a merger. The possible states of the economy and each

Question:

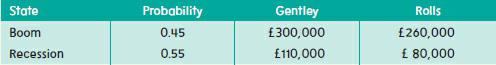

Gentley plc and Rolls Manufacturing are considering a merger. The possible states of the economy and each company’s value in that state are shown here:

Gentley currently has a bond issue outstanding with a face value of £140,000. Rolls is an all equity company.

(a) What is the value of each company before the merger?

(b) What are the values of each company’s debt and equity before the merger?

(c) If the companies continue to operate separately, what are the total value of the companies, the total value of the equity, and the total value of the debt?

(d) What would be the value of the merged company? What would be the value of the merged company’s debt and equity?

(e) Is there a transfer of wealth in this case? Why?

(f) Suppose that the face value of Gentley’s debt was £100,000. Would this affect the transfer of wealth?

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe