The expected rates of return on the French firms, Publicis and Renault, the market portfolio (CAC 40)

Question:

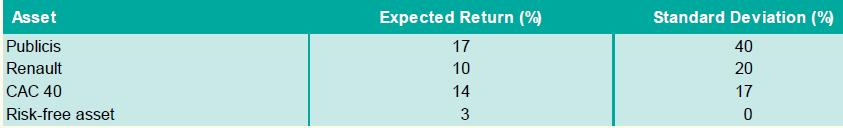

The expected rates of return on the French firms, Publicis and Renault, the market portfolio (CAC 40) and the risk-free asset are given below, along with the standard deviations of these returns.

(a) Assuming that the returns are explained by the capital asset pricing model, specify the betas for Publicis and Renault and the risk of a portfolio of Publicis and Renault with an expected return the same as the CAC 40.

(b) Specify the composition of a portfolio consisting of the CAC 40 and the risk-free asset that will produce an expected return of 10 per cent. Contrast the risk on this portfolio with the risk of Renault.

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe