Inorganic Chemicals (IC) processes salt into various industrial products. In July 2020, IC incurred joint costs of

Question:

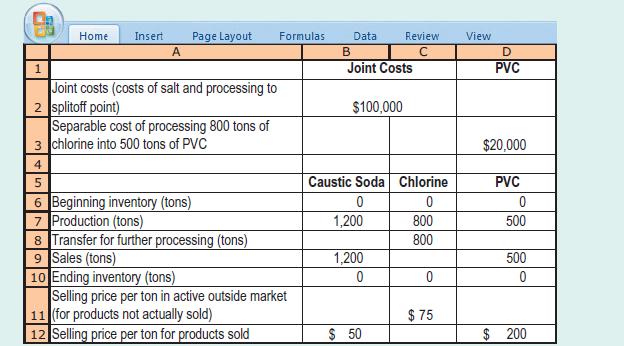

Inorganic Chemicals (IC) processes salt into various industrial products. In July 2020, IC incurred joint costs of $100,000 to purchase salt and convert it into two products: caustic soda and chlorine. Although there is an active outside market for chlorine, IC processes all 800 tons of chlorine into 500 tons of PVC (polyvinyl chloride), which is then sold. There were no beginning or ending inventories of salt, caustic soda, chlorine, or PVC in July. Information for July 2020 production and sales follows:

Required:

1. Allocate the joint costs of $100,000 between caustic soda and PVC under (a) the sales value at the split-off method (b) the physical-measure method.

2. Allocate the joint costs of $100,000 between caustic soda and PVC under the NRV method.

3. Under the three allocation methods in requirements 1 and 2, what is the gross-margin percentage of (a) caustic soda (b) PVC?

4. Lifetime Swimming Pool Products offers to purchase 800 tons of chlorine in August 2020 at $75 per ton. Assume all other production and sales data are the same for August as they were for July. This sale of chlorine to Lifetime would mean that no PVC would be produced by IC in August. How would accepting this offer affect IC’s August 2020 operating income?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan