On January 1 of 2017 your company purchased the following equipment. How much will you depreciate for

Question:

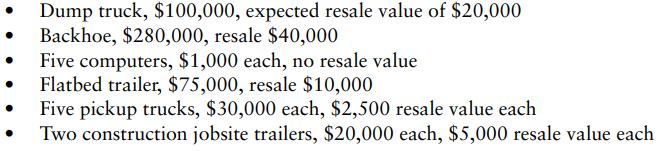

On January 1 of 2017 your company purchased the following equipment. How much will you depreciate for the fiscal year ending in 2020 when you have your CPA file your tax return on April 15, 2021 assuming a straight-line depreciation method? How much will you have depreciated total as of this point in time? What are the remaining book values for each piece of equipment?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Accounting And Financial Management For Construction Project Managers

ISBN: 9781138550650

1st Edition

Authors: Len Holm

Question Posted: