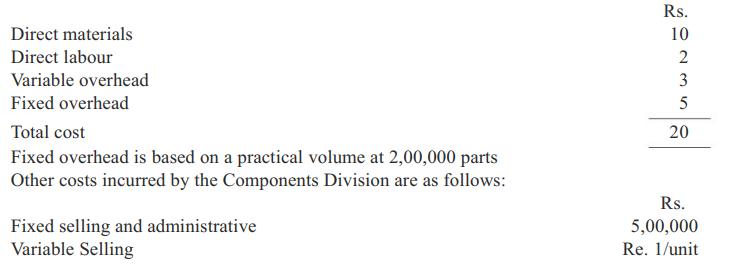

The Components Division produces a part that is used by the Goods Division. The cost of manufacturing

Question:

The Components Division produces a part that is used by the Goods Division. The cost of manufacturing the part is given below:

The part usually sells for between Rs. 28 and Rs. 30 in the external market. Currently, the Components Division is selling it to external customers for Rs. 29. The division is capable of producing 200,000 units of the part per year; however, because of a weak economy, only 150,000 parts are expected to be sold during the coming year. The variable selling expenses are avoidable if the part is sold internally.

The Goods division has been buying the same part from an external supplier for Rs. 28. It expects to use 50,000 units of the part during the coming year. The manager of the Goods Division has offered to buy 50000 units from the Components Division for Rs. 18 per unit.

Required:

(i).Determine the minimum transfer price that the Components Division would accept.

(ii). Determine the maximum transfer price that the manager of the goods division would pay.

(iii). Should an internal transfer take place? Why? If you were the manager of the Components Division, would you sell the 50,000 components for Rs. 18 each? Explain.

(iv). Suppose that the average operating assets of the Components Division total Rs. 100 lakhs, Compute the ROI for the coming year, assuming that the 50,000 units are transferred to the Goods Division for Rs. 21 each.

Step by Step Answer: