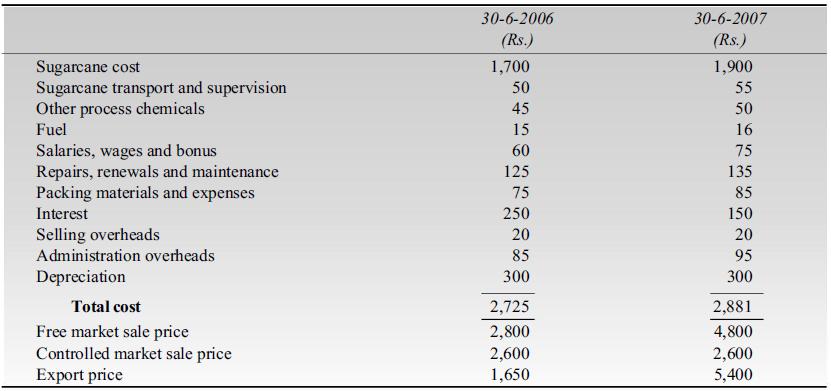

You are the Chief Accountant of a sugar factory, whose cost of production per tonne of sugar

Question:

You are the Chief Accountant of a sugar factory, whose cost of production per tonne of sugar is given below:

Salaries, wage and bonus include administration salaries Rs. 20.

You have been valuing the closing stock of sugar consistently at cost or market price whichever is lower. For the purpose of arriving at cost you have been taking the total cost as given above.

The auditor objects to the method of arriving at cost adopted in view of Accounting Standard No. 2 on valuation of inventory and he wants to exclude the depreciation, interest, administration and selling overheads. Keeping the stipulations of the Accounting Standard-2 in view, give your opinion on:

(a) What shall be the cost for the purpose of valuation of stock in both the above years?

(b) In view of the accumulation of heavy stock, the directors want to be consistent with the method of valuation of stocks as in the past in order to present a reasonable financial position. Will you be able to convince the auditors that the method of arriving at total cost is the correct method and, if yes, how?

(c) If the authors opinion is adopted, what shall be the nature of disclosure in the published accounts, if any?

(d) What shall be the basis for valuing stock in each of the above years?

Note:

Local sales price include excise duty of Rs. 500 per tonne.

Step by Step Answer: