Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known for

Question:

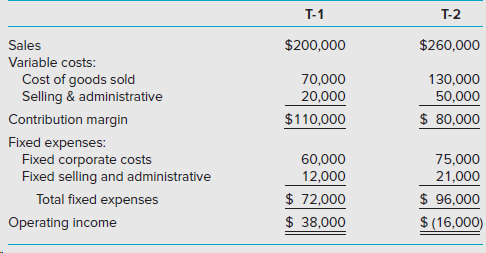

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statements (see below), he agreed that T-2 should be dropped. If T-2 is dropped, sales of T-1 are expected to increase by 10% next year, but the firm€™s cost structure will remain the same.

Required

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1. (Round answer to nearest whole dollar.)

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2? (Round your answer to 2 decimal places. For example, 56.568% = 56.57%.)

3. What is the required percentage increase in sales (rounded to 2 decimal places) from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $45,000?

4. What strategic factors should be considered in deciding whether to drop or to keep T-2?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith