Use the same information for this problem as you did for Problem 12-47, except that the discount

Question:

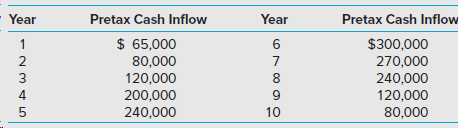

Use the same information for this problem as you did for Problem 12-47, except that the discount rate is 10% (not 12%), the investment is subject to taxes, and the projected pretax operating cash inflows are as follows:

Jensen has been paying 25% for combined federal, state, and local income taxes, a rate that is not expected to change during the period of this investment. The firm uses straight-line depreciation. Assume, for simplicity, that MACRS depreciation rules do not apply.

Required

Using Excel, compute the following for the proposed investment:

1. The payback period (in years), under the assumption that the cash inflows occur evenly throughout the year. Round your answer to 1 decimal place.

2. The accounting (book) rate of return based on (a) initial investment, and (b) average investment. Round both answers to 1 decimal place (e.g., 13.417% = 13.4%).

3. The net present value (NPV), rounded to the nearest whole dollar.

4. The present value payback period of the proposed investment under the assumption that the cash inflows occur evenly throughout the year. (Note: Use the formula at the bottom of Appendix C, Table 1 to calculate present value factors.)

5. The internal rate of return (IRR), rounded to 1 decimal place (e.g., 5.491% = 5.5%).

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith