A producer of gold has expenses of 800 per ounce of gold produced. Assume that the cost

Question:

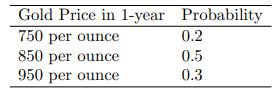

A producer of gold has expenses of 800 per ounce of gold produced. Assume that the cost of all other production-related expenses is negligible and that the producer will be able to sell all gold produced at the market price. In one year, the market price of gold will be one of three possible prices, corresponding to the following probability table:

The producer hedges the price of gold by buying a 1-year put option with an exercise price of 900 per ounce. The option costs 100 per ounce now, and the continuously compounded risk-free interest rate is 6%. Calculate the expected 1-year profit per ounce of gold produced.

(A) 0.00

(B) 3.17

(C) 6.33

(D) 8.82

(E) 11.74

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: