Consider European and American options on a nondividend-paying stock. You are given: (i) All options have the

Question:

Consider European and American options on a nondividend-paying stock.

You are given:

(i) All options have the same strike price of 100.

(ii) All options expire in six months.

(iii) The continuously compounded risk-free interest rate is 10%.

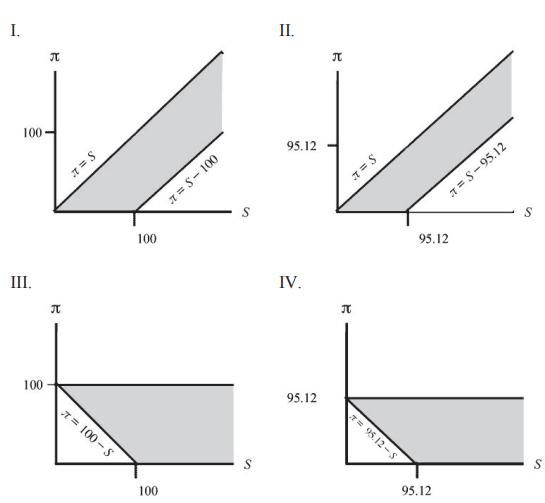

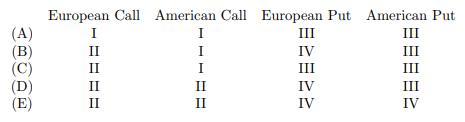

You are interested in the graph for the price of an option as a function of the current stock price. In each of the following four charts I–IV, the horizontal axis, S, represents the current stock price, and the vertical axis, π, represents the price of an option.

Match the option with the shaded region in which its graph lies. If there are two or more possibilities, choose the chart with the smallest shaded region

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: