Consider the following information about a European call option on stock ABC: The strike price is

Question:

Consider the following information about a European call option on stock ABC:

• The strike price is $95.

• The current stock price is $100.

• The time to expiration is 2 years.

• The continuously compounded risk-free rate is 5% annually.

• The stock pays no dividends.

• The price is calculated using a 2-step binomial model where each step is one year in length.

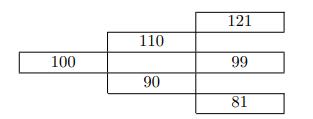

The stock price tree is shown below:

Calculate the price of the call on stock ABC.

(A) Less than 13.50

(B) At least 13.50, but less than 14.00

(C) At least 14.00, but less than 14.50

(D) At least 14.50, but less than 15.00

(E) At least 15.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: