For a one-period arbitrage-free binomial model with two nondividend-paying securities, you are given: (i) The following price

Question:

For a one-period arbitrage-free binomial model with two nondividend-paying securities, you are given:

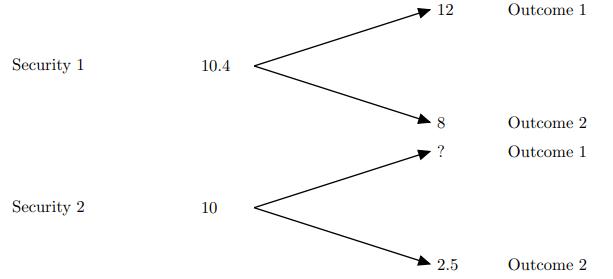

(i) The following price evolution of the two securities:

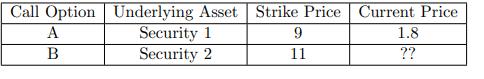

(ii) The following information about two European call options:

Calculate the current price of call option B.

Transcribed Image Text:

Security 1 Security 2 10.4 10 12 00 2.5 Outcome 1. Outcome 2 Outcome 1 Outcome 2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Call option A pays 12 9 3 in Outcome 1 and 8 9 0 in Outcome 2 To determin...View the full answer

Answered By

Anjali Arora

Having the experience of 16 years in providing the best solutions with a proven track record of technical contribution and appreciated for leadership in enhancing team productivity, deliverable quality, and customer satisfaction. Expertise in providing the solution in Computer Science, Management, Accounting, English, Statistics, and Maths.

Also, do website designing and Programming.

Having 7 yrs of Project Management experience.

100% satisfactory answers.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Let F run T1 and T2 in interleaved fashion if the initial value of A is 25 and B is 25 follow the values of AB if the transactions in F run as follows then write the final values of A B

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

Question 4: Partners M, N, and O agreed to share the net income or loss in the ratio of 5:4:3 respectively. Their capital balances were Rs.80, 000, Rs. 70, 000 and Rs. 60, 000. They decided that "O"...

-

Quick Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2007: Revenues ........$229,600 Expenses ............(160,100) Pretax...

-

A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of 400, 000 population. The equipment can wash, on the average, 12 cars per hour, using two men to...

-

Should the requirements of the UCC be subject to the application of reliance theories? Go back and review the facts in Case 21-3 about the coal contract. Should silence followed by contract execution...

-

McLennon Company had an Accounts Receivable balance of $320,000 and a credit balance in Allowance for Uncollectible Accounts of $16,700 at January 1, 2014. During the year, the company recorded the...

-

Map this ER diagram to a Relational Model and normalize it if needed. employee EMP_ID INT EMP_Frame VARCHAR(40) EMP_Lname VARCHAR(40) EMP_Sex VARCHAR(1) EMP_Birthdate DATE EMP_Salary INT Indexes...

-

For a 10-period binomial stock price model, you are given: (i) The length of each period is one year. (ii) The current stock price is 1,000. (iii) At the end of every year, the stock price will...

-

You are given the following regarding stock of Widget World Wide (WWW): (i) The stock is currently selling for $50. (ii) One year from now the stock will sell for either $40 or $55. (iii) The stock...

-

Deep linking takes place regularly over the Internet. Anytime you make a Web page that links to another site and bypasses the home page of that site you are deep linking. Should this practice be...

-

A35000$ machine has 6 yeas depreciable life and a 10000$ salvage value at the end of the years. Compute the depreciation schedule and the book value at the end of each year using sum of year's digits...

-

4. The budgeting decisions. rule is considered the "best" in principle in making capital A) internal rate of return B) payback period C) average accounting return D) net present value

-

When inventory is sold, the cost of the product is transferred from the balance sheet to the income statement as cost of goods sold. True False

-

Investing activities on the statement of cash flows include buying equipment that is held for long - term use. True False

-

B Inc. has ne income of $30,000 for the current year, including dividends received from taxable Canadian corporations of $2,000 and taxable capital gains of $3,000. B Inc. donated $25,000 to a...

-

In a period of rising prices, how would the following ratios be affected by the accounting decision to select LIFO, rather than FIFO, for inventory valuation? * Gross Margin * Current Ratio * Asset...

-

Could the owner of a business prepare a statement of financial position on 9 December or 23 June or today?

-

Randy Duck out has been asked to develop an estimate of the per-unit selling price (the price that each unit will be sold for) of a new line of hand-crafted booklets that offer excuses for missed...

-

Develop a statement that expresses the extent to which cost estimating topics also apply to estimating benefits. Provide examples to illustrate.

-

On December 1, AI Smith purchased a car for $18,500. He paid $5000 immediately and agreed to pay three additional payments of $6000 each (which includes principal and interest) at the end of 1, 2,...

-

Bags of flour labelled 1 kg from a supermarket are weighed. Most of the weights measured are very close to 1 kg , with some a little more and others a little less. Those which are further away from 1...

-

Kirk is learning a new job by watching his co - workers and asking questions. He notices that some of his co - workers stress the importance of certain tasks, while others do not do these tasks at...

-

Our team is preparing for the next round of bids on a new collection of sculptures. As you can see, sales are flat in the Western region, the presenter says. We need to negotiate a good rate to...

Study smarter with the SolutionInn App