For two European call options, Call-I and Call-II, on a stock, you are given: Suppose you just

Question:

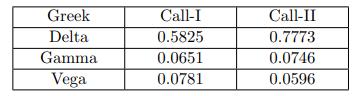

For two European call options, Call-I and Call-II, on a stock, you are given:

Suppose you just sold 1000 units of Call-I.

Determine the numbers of units of Call-II and stock you should buy or sell in order to both delta-hedge and gamma-hedge your position in Call-I.

(A) Buy 95.8 units of stock and sell 872.7 units of Call-II

(B) Sell 95.8 units of stock and buy 872.7 units of Call-II

(C) Buy 793.1 units of stock and sell 692.2 units of Call-II

(D) Sell 793.1 units of stock and buy 692.2 units of Call-II

(E) Sell 11.2 units of stock and buy 763.9 units of Call-II

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: