Suppose the current time is 0. Consider two European put options on the same underlying stock and

Question:

Suppose the current time is 0. Consider two European put options on the same underlying stock and the same maturity date T, but with different strike prices K1 and K2, where K1 ≤ K2. The prices of the above options are denoted by P(K1) and P(K2), respectively.

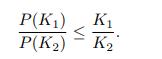

Use no-arbitrage arguments to show that

Transcribed Image Text:

P(K₁) P(K₂) VI K₁ K₂

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Certainly The principle of noarbitrage in options pricing suggests that there shouldnt exist an oppo...View the full answer

Answered By

Vincent Omondi

I am an extremely self-motivated person who firmly believes in his abilities. With high sensitivity to task and operating parameters, deadlines and keen on instructions, I deliver the best quality work for my clients. I handle tasks ranging from assignments to projects.

4.90+

109+ Reviews

314+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider two European call options on the same underlying and with the same maturity, but with different strike prices, K1 and K2 respectively. Suppose that K1 > K2. Prove that the option prices...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Stock A has a standard deviation of 2.3 and the market portfolio standard deviation is 3.2. The covariance of returns of the market and Stock A is 4.26. What is the correlation coefficient between...

-

A heating section consists of a 10 inch diameter duct which houses a 8 kW electric resistance heater. Air enters the heating section at 14.7 psia, 40oF and 35% relative humidity at a velocity of 21...

-

Consider the broad shifts in marketing. Do any themes emerge in them? Can you relate the shifts to the major societal forces? Which force has contributed to which shift?

-

Lighthouse Paper Company manufactures newsprint. The product is manufactured in two departments, Papermaking and Converting. Pulp is first placed into a vessel at the beginning of papermaking...

-

What stakeholder affected by their behavior was Gilead weighting very lightly when it decided what to tell the FDA about the medicines it wished to have permission to sell?

-

Selected transactions for Babcock Company during November of the current year are listed in Problem 5-3A. In Problem 5-3A, the following were selected from among the transactions completed by Babcock...

-

A 250 kg beam is raised through 25 m at a constant velocity by a crane. a) Draw an FBD for the beam. b) Determine the work done by the crane on the beam. c) Determine the work done by gravity on the...

-

To settle an urgent debt payable in US dollars in one year, Jeff has decided to (reluctantly!) sell his favorite Rolls Royce car in exchange for a fixed sum payable in British pounds in one year....

-

For K 0, let C(K) denote the price of a K-strike European call option on a stock. Let 0 1 2. Define K = K 1 + (1 )K 2 , where is a real number, not necessarily between 0 and 1. (a) Determine all...

-

Sachs Brandss defined benefit pension plan specifies annual retirement benefits equal to 1.6% service years final years salary, payable at the end of each year. Angela Davenport was hired by Sachs...

-

During the years ended June 30, 20X6, and 20X7, Sampson University conducted a diabetes research project financed by a $2,000,000 gift from an alumnus. This entire amount was pledged by the donor on...

-

The City of Corona, California, Governmental Funds Statement of Revenues, Expenditures, and Changes in Fund Balances reports an increase in Fund Balances of $31,152,287. Required Based on the...

-

Joshua Village issued the following bonds during the-year ended June 30, 20X5: How much of these bonds should be accounted for as Joshuas General Long-Term Liabilities? a. $500,000. b. $200,000. c....

-

Robeson County has a Capital Projects Fund for its courthouse renovations. The appropriation authority for the fund continues until the end of the project. The voters approved a bond issue for the...

-

The Village of Nathan has 43 employees who work in departments accounted for in the General Fund. As of the beginning of the fiscal year, the compensated absences liability associated with those...

-

Cure-all, Inc., has developed a drug that will diminish the effects of aging. Cure-all has spent $1,000,000 on research and development and $2,108,000 for clinical trials. Once the drug is approved...

-

1. Use these cost, revenue, and probability estimates along with the decision tree to identify the best decision strategy for Trendy's Pies. 2. Suppose that Trendy is concerned about her probability...

-

Investors require a 15 percent rate of return on Levine Companys stock (rs =15%). a. What will be Levines stock value if the previous dividend was D0 = $2 and if investors expect dividends to grow at...

-

Wayne-Martin Electric Inc. (WME) has just developed a solar panel capable of generating 200 percent more electricity than any solar panel currently on the market. As a result, WME is expected to...

-

Tausig Technologies Corporation (TTC) has been growing at a rate of 20 percent per year in recent years. This same growth rate is expected to last for another 2 years. a. If D0 = $1.60, rs = 10%, and...

-

Thornton Manufacturing Company was started on January 1 , 2 0 1 8 , when it acquired $ 8 1 , 0 0 0 cash by issuing common stock. Thornton immediately purchased office furniture and manufacturing...

-

1. Design a TM to perform circular left-shift operation. 2. Design a TM to accept the language (0a, 1ab, 2bab 1}. Draw the state-transition diagram, and explain how your TM operates. 3. Let w =...

-

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1 . 6 % times service years times final year's salary, payable at the end of each year. Angela Davenport was...

Study smarter with the SolutionInn App