The Ashwaubenon Company (Ash Co) needs to raise capital to support its rapidly growing business. One proposal

Question:

The Ashwaubenon Company (Ash Co) needs to raise capital to support its rapidly growing business. One proposal is to publicly issue a certain number of equity units, each of which consists of one share of stock and a warrant to purchase one share of stock.

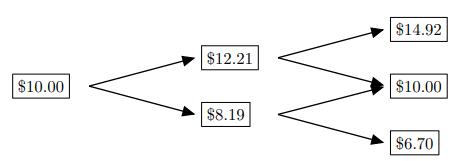

Assume that the price of the underlying asset follows a binomial tree with 1-year time steps as follows:

The warrant provides the right to purchase one share of the stock for $9 at the first anniversary or, if not exercised, for $10 at the second anniversary.

Assume further that:

• The stock pays no dividend.

• The risk-free interest rate is 4% per annum.

Calculate the value of the warrant using the binomial tree.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: