The current price of a nondividend-paying stock is 40 and the continuously compounded risk-free interest rate is

Question:

The current price of a nondividend-paying stock is 40 and the continuously compounded risk-free interest rate is 8%. You enter into a short position on 3 call options, each with 3 months to maturity, a strike price of 35, and an option premium of 6.13. Simultaneously, you enter into a long position on 5 call options, each with 3 months to maturity, a strike price of 40, and an option premium of 2.78.

All 8 options are held until maturity.

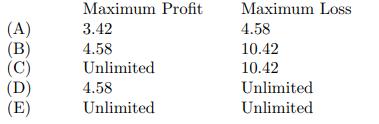

Calculate the maximum possible profit and the maximum possible loss for the entire option portfolio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: