The dividend yield on a stock and the interest rate used to discount the stock's cash flows

Question:

The dividend yield on a stock and the interest rate used to discount the stock's cash flows are both continuously compounded. The dividend yield is less than the interest rate, but both are positive.

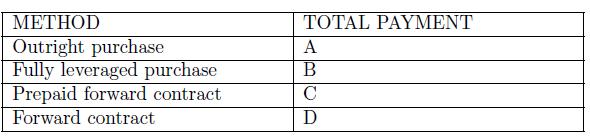

The following table shows four methods to buy the stock and the total payment needed for each method. The payment amounts are as of the time of payment and have not been discounted to the present date.

Determine which of the following is the correct ranking, from smallest to largest, for the amount of payment needed to acquire the stock.

(A) C

(B) A

(C) D

(D) C

(E) A

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: